The model portfolios have been constructed based on the VIG Investment Clock and our tactical asset allocation strategy, using following principles: we have selected 4-5 investment funds from our own range.

In all three currencies, the Conservative Portfolio targets a composition of 40% equities and 60% bonds, while the Dynamic Portfolio focuses on 60% equities and 40% bonds. The key economic factors behind these allocations include global and regional economic trends, expectations of central bank interest rate cuts, and investor sentiment.

Conservative portfolio focuses more on stability and fixed income assets (bonds), whereas dynamic portfolios aim for higher-yield outlook, using the volatility of equities. ESG considerations remain important, particularly in emerging markets and mixed-asset funds.

Investment Approach

According to our economic cycle forecasting model, the VIG Investment Clock, global growth prospects remain favourable. The upswing phase of the economic cycle is typically supportive of equities and commodity investments.

Within equity markets, however, U.S. stocks currently appear less compelling than their emerging market or even European counterparts. Corporate earnings growth for this year is expected to remain in double digits, yet on Wall Street investors are increasingly favouring small-cap stocks. At the sector level, commodity-related industries – particularly energy – appear especially well positioned.

The recovery phase remains less supportive for bond markets. When economic conditions are strong, central banks are under less pressure to cut interest rates. While rate cuts are currently expected in the U.S., the policy rate applies primarily to overnight transactions and is therefore unlikely to materially affect longer maturities. This is particularly relevant given that Kevin Warsh, who is set to take office as Fed Chair in May, has indicated that he does not intend to implement measures targeting the long end of the yield curve.

Hungarian government bonds, however, offer a more constructive outlook, supported by the relative stability of the forint and attractive yield levels. Should investors begin to price in the possibility of a government change in the upcoming spring parliamentary elections – potentially unlocking EU funds – this could lead to further appreciation in Hungarian government bond markets.

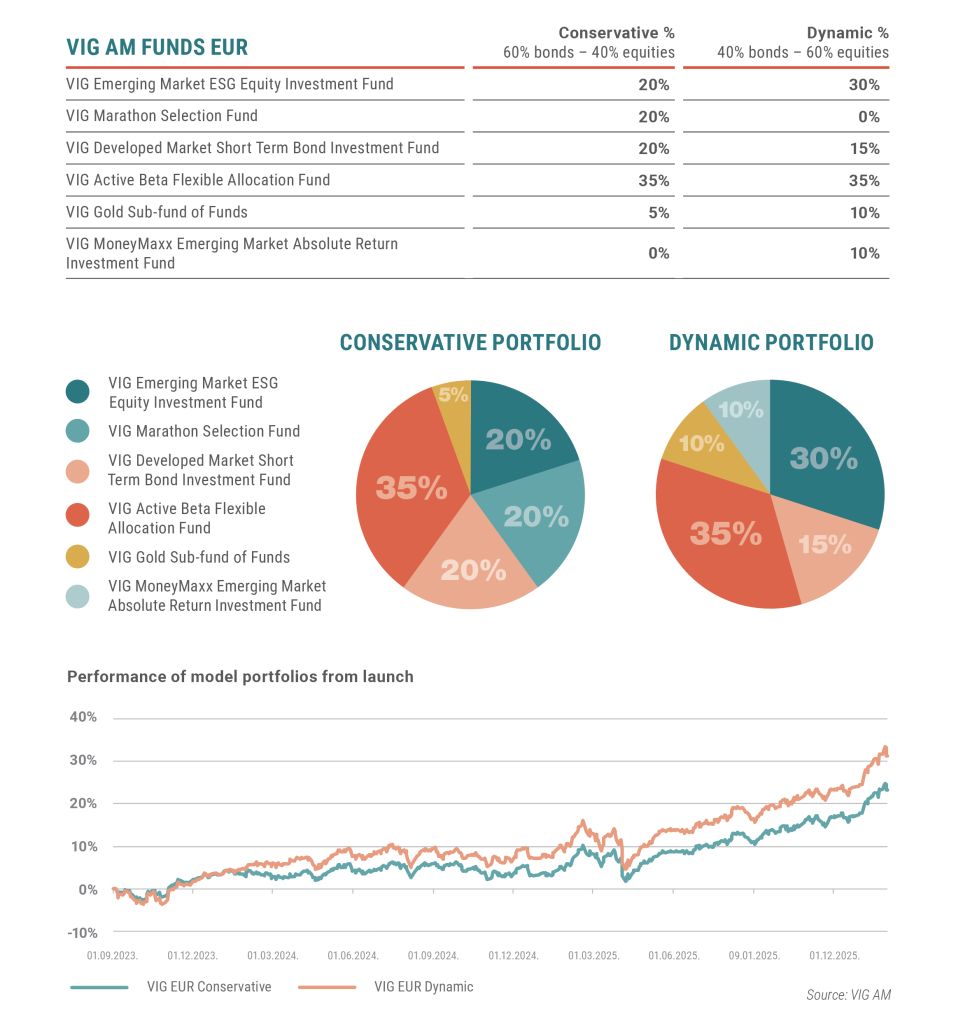

VIG EUR Portfolios

In light of current market trends, we have left the composition of our more conservative, prudently managed portfolio unchanged.

In our higher-risk, dynamic model portfolio, however, we replaced our holding in the VIG Marathon Selection Fund with the VIG MoneyMaxx Emerging Markets Absolute Return Fund.

This year could prove favourable for emerging equity markets. Valuations remain attractive, and corporate earnings growth may exceed 20%. Combined with the weakening U.S. dollar, these factors could position emerging markets as a preferred destination for global capital rotating away from Wall Street.

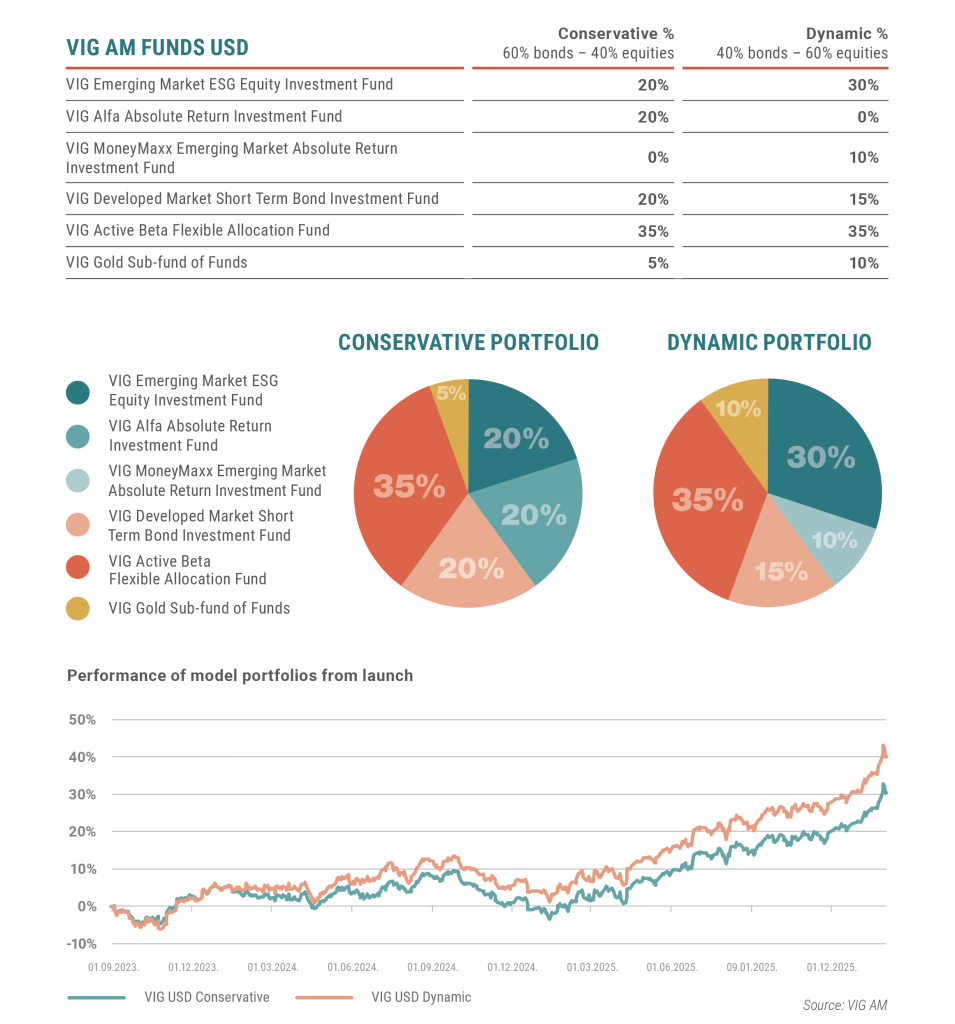

VIG USD Portfolios

We have also implemented tactical adjustments in our USD-based model portfolios. The composition of the more conservative portfolio remains unchanged. In the higher-equity, dynamic model portfolio, however, we replaced the VIG Alfa Absolute Return Fund with the VIG MoneyMaxx Emerging Markets Absolute Return Fund, reflecting the favourable outlook for emerging equity markets discussed earlier.

The largest portfolio allocation continues to be the VIG Active Beta Flexible Allocation Fund, which provides broad exposure to Europe’s most popular listed equities while maintaining a strong risk management framework.

Disclaimer

This is a distribution announcement. Detailed information is needed to make a well-founded investment decision. Please inform yourself thoroughly regarding the Fund’s investment policy, potential investment risks and distribution in the Fund’s key investment information, official prospectus and management regulations available at the Fund’s distribution outlets and on the Asset Management’s website (www.vigam.hu). The costs related to the distribution of the fund (buying, holding, selling) can be found in the fund’s management regulations and at the distribution outlets. Past returns do not predict future performance. Please note that in comparison with other investment funds, the return achieved may be affected by differences in the reference index and therefore the investment policy.

The future performance that can be achieved by investing may be subject to tax, and the tax and duty information relating to specific financial instruments and transactions can only be accurately assessed on the basis of the individual circumstances of each investor and may change in the future. It is the responsibility of the investor to inform himself about the tax liability and to make the decision within the limits of the law.

The information contained in this leaflet is for informational purposes only and does not constitute an investment recommendation, an offer or investment advice. VIG Asset Management Hungary Closed Company Limited by Shares accepts no liability for any investment decision made on the basis of this information and its consequences.

The Asset Management’s license number for managing alternative investment funds (AIFM) is: H-EN-III-6/2015. The Fund Manager’s license number for UCITS fund management (collective portfolio management) is: H-EN-III-101/2016.