The long-term valuation of equities

Achieving inflation-adjusted returns over the long run is possible through both short- and long-duration bonds as well as equity investments. However, the longer the bond duration or the higher the equity allocation in a hypothetical 100-year portfolio, the higher the resulting real return—albeit with greater volatility compared with a short-term bond strategy.

Benjamin Graham, the renowned value investor of the last century, argued that an investor’s portfolio should never hold less than 25% or more than 75% equities. In his view, when equity markets are expensive, allocations should be closer to 25%, while during periods of market stress—when prices fall and companies become undervalued—the equity share should move toward 75%. This reactive allocation approach, adjusting the balance between equities and bonds as valuations shift, can further enhance real returns. This is why the regular assessment of market valuations remains so important: they ultimately reflect investors’ collective expectations of future economic and financial-market conditions.

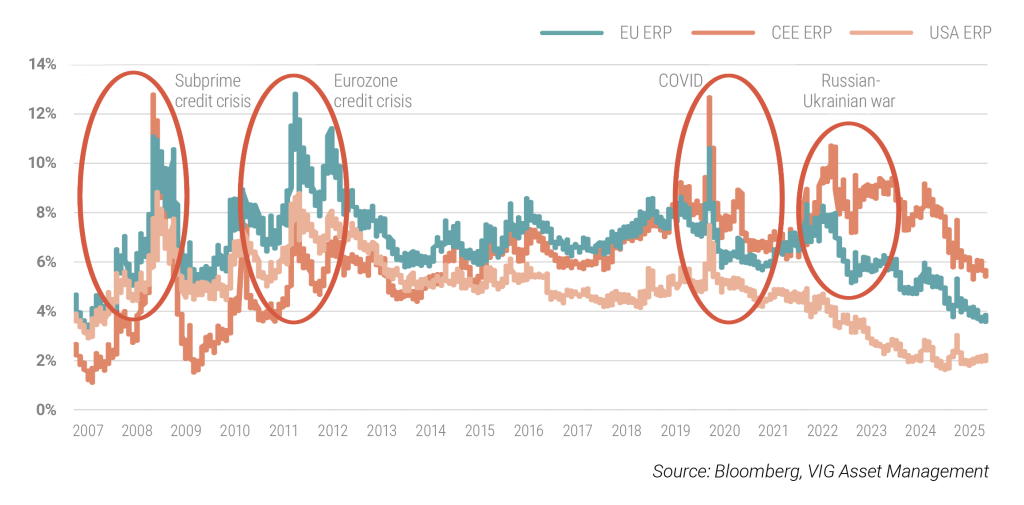

Another fundamental principle of equity investing is that valuations are poor short-term indicators—indeed, in the current rally, investors are not scrutinising technology-sector P/E ratios as closely as one might expect. Over longer horizons, however, valuations become key signals. The Equity Risk Premium (ERP) captures whether optimism or caution is priced into equities relative to bonds. As the chart below illustrates, U.S. equities have built up a level of optimism not seen since before the 2007 credit crisis, with an ERP of barely 1%. Historically, when the ERP has spiked—during the global financial crisis, the eurozone crisis, or the COVID shock—it has coincided with sharp corrections in equity markets. The same pattern emerged during the Asian financial crisis in 1997 and the bursting of the dot-com bubble in 2000. When equities become overvalued and the ERP falls too low, as it is today, subsequent drawdowns of 40–50% have not been uncommon.

While the U.S. equity market may continue to rise in 2026, any shift in investor perception or the emergence of a new, unforeseen risk could trigger a significant revaluation of equities relative to bonds, potentially ushering in a bear market. This is not our base-case scenario, but investors should be mindful of the risk.

Equity Risk Premiums (ERP) 2007-2025

Explore moreInvestment Outlook 2026

Get the publicationDownload

Explore moreInvestment Outlook 2026

Get the publicationDownload

This is a distribution announcement. Detailed information is needed to make a well-founded investment decision. Please inform yourself thoroughly regarding the Fund's investment policy, potential investment risks and distribution in the Fund's key investment information, official prospectus and management regulations available at the Fund's distribution outlets and on the Asset Management's website (www.vigam.hu). The costs related to the distribution of the fund (buying, holding, selling) can be found in the fund's management regulations and at the distribution outlets. Past returns do not predict future performance. Please note that in comparison with other investment funds, the return achieved may be affected by differences in the reference index and therefore the investment policy. The future performance that can be achieved by investing may be subject to tax, and the tax and duty information relating to specific financial instruments and transactions can only be accurately assessed on the basis of the individual circumstances of each investor and may change in the future. It is the responsibility of the investor to inform himself about the tax liability and to make the decision within the limits of the law. The information contained in this leaflet is for informational purposes only and does not constitute an investment recommendation, an offer or investment advice. VIG Asset Management Hungary Closed Company Limited by Shares accepts no liability for any investment decision made on the basis of this information and its consequences.

The Asset Management’s license number for managing alternative investment funds (AIFM) is: H-EN- III-6/2015. The Fund Manager’s license number for UCITS fund management (collective portfolio management) is: H-EN-III-101/2016.