Technical view of the markets

A long term forecast in technical analysis should always be combined with thoughts that were established back in the 1930’s by the greatest pioneers in this analysis methods.

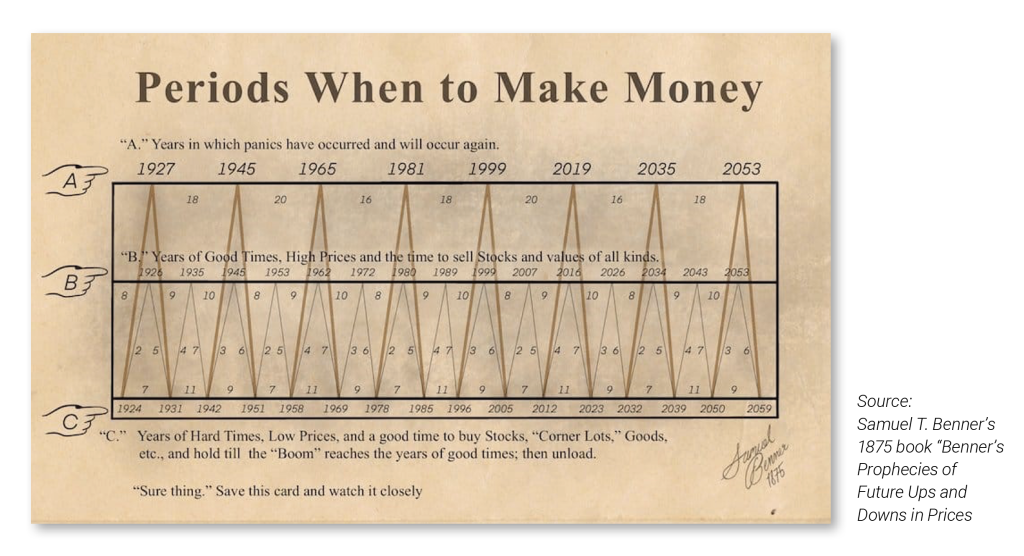

One of these working examples is the Benner Cycle, which proved to be a rock solid method in the past century. The Benner Cycle, developed in 1875 by farmer-analyst Samuel Benner, is a long-term market rhythm model built on recurring historical patterns of booms, busts and panics observed in 19th-century commodity and financial markets.

According to the Benner Cycle’s long-term pattern, 2026 may mark the final leg of the current multi-year market upswing—a late-cycle rally that often arrives suddenly and unexpectedly. The structure of the cycle suggests that while the broader trend into 2026 remains upward, investors may be approaching a pivotal turning point similar to previous peaks observed in 1999, 2007 and 2016.

In all three cases, markets experienced strong acceleration before the cycle shifted. Two of these moments—1999 and 2007—were followed by significant price corrections, while 2016 produced a correction in time rather than in price, with markets consolidating sideways before resuming their advance.

If the Benner pattern holds, 2026 could therefore represent both opportunity and heightened risk: the final phase of a long rally, but also a period when vigilance, diversification and disciplined positioning become increasingly essential.

S&P 500

Looking at the long-term performance outlook of the S&P 500, we can clearly see the magnitude of the rally that this leading index has delivered. We are approaching the end of the fifth Elliott wave in the 2025 upward leg, which may not have fully completed yet. The index has turned parabolic this year, and when combined with an RSI showing weakening market strength through lower highs, this could serve as an early warning signal for the entire year ahead.

The S&P 500 will most likely experience a correction in the coming months; however, given the strong underlying fundamentals, this correction may unfold more in time than in price—resulting in a longer period of sideways movement rather than a sharp decline. After such a parabolic advance, the forecasted yearly performance is expected to be lower than in 2025 and could even fall below the average annual returns of the past five years.

NASDAQ composite

A similar performance pattern appears on the Nasdaq Composite chart, showing the same parabolic advance. Based on the RSI, this index still looks stronger than the S&P 500, yet a correction is also due here. Given the inherently more volatile nature of the Nasdaq, this correction will most likely occur through price rather than time, potentially bringing the index down toward the 20,000 level before the broader trend resumes. Over the course of the year, a predominantly sideways movement is expected in the coming months, resulting in below-average overall performance.

Crude oil WTI

WTI remains in a long-term downward trend, which appears set to continue. However, the slope of this decline has shifted into a more sideways pattern, keeping WTI contained between the 60–80 USD range. The upward-ticking RSI also indicates a weakening of the multi-year downtrend, suggesting that this trading band will most likely persist through 2026.

US 10YR

U.S. long-term yields have moved sideways with a slight downward bias in recent years. The chart has formed a triangle pattern, and its eventual breakout will signal the next major directional move. Current indications suggest that 10-year yields may break lower, falling through both the long-term rising support line and the lower boundary of the triangle. The declining RSI reinforces this view. Should this breakdown occur in the early weeks of 2026, it would likely mark the beginning of a sustained downward yield trend that could persist throughout 2026—and potentially even longer.

GOLD

Gold has made an exuberant move in recent years—one that is unusual when compared with the broader performance of equity markets. The advance has turned parabolic, supported by extreme RSI readings. Such conditions typically signal a highly overvalued market that may be vulnerable to a bubble-like correction. While this has not yet appeared on the current chart, a decline in Gold that pushes the RSI below 40 at any point in 2026 would likely accelerate the price correction. In an overextended market such as this, 10–15% pullbacks are normal, and if the RSI rule holds, these could present attractive buying opportunities.

Explore moreInvestment Outlook 2026 Get the publicationDownload

This is a distribution announcement. Detailed information is needed to make a well-founded investment decision. Please inform yourself thoroughly regarding the Fund's investment policy, potential investment risks and distribution in the Fund's key investment information, official prospectus and management regulations available at the Fund's distribution outlets and on the Asset Management's website (www.vigam.hu). The costs related to the distribution of the fund (buying, holding, selling) can be found in the fund's management regulations and at the distribution outlets. Past returns do not predict future performance. Please note that in comparison with other investment funds, the return achieved may be affected by differences in the reference index and therefore the investment policy. The future performance that can be achieved by investing may be subject to tax, and the tax and duty information relating to specific financial instruments and transactions can only be accurately assessed on the basis of the individual circumstances of each investor and may change in the future. It is the responsibility of the investor to inform himself about the tax liability and to make the decision within the limits of the law. The information contained in this leaflet is for informational purposes only and does not constitute an investment recommendation, an offer or investment advice. VIG Asset Management Hungary Closed Company Limited by Shares accepts no liability for any investment decision made on the basis of this information and its consequences.

The Asset Management’s license number for managing alternative investment funds (AIFM) is: H-EN- III-6/2015. The Fund Manager’s license number for UCITS fund management (collective portfolio management) is: H-EN-III-101/2016.