Outlook for 2026

2025 has been a good year for many asset classes after the Liberation Day turmoil. Gold prices soared massively, equity markets performed well and we have also seen outstanding returns in pockets of the fixed income space, particularly in emerging markets.

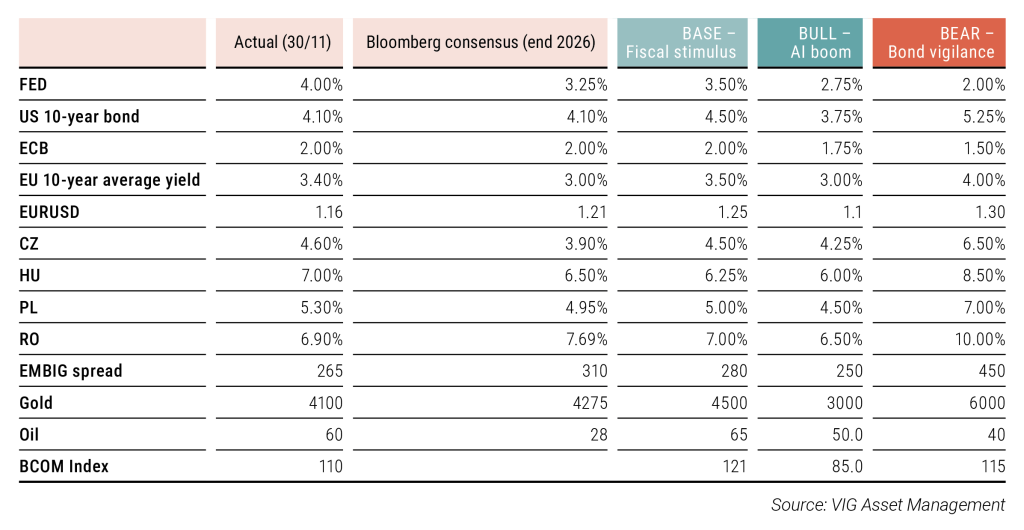

How do we go further? As it remains an impossible task to assess the whole spectrum of the probability distribution, in our 2026 outlook we focus on three themes that might come to the fore next year. Our base case covers a positive fiscal story, our bull case is about a world with an AI-driven productivity jump and the resulting low inflation while our bear case is about rising yields due to resurfacing global debt fears. These stories cover some of the known unknowns capital markets are facing. We admit our selection of themes is completely subjective: the world is more complicated and also there are many unknown unknowns waiting for us but we think it is important to play with the numbers and guide investors how a portfolio would fare if these real risks would materialize.

Our methodology is not about a scientific approach. The output is the professional estimate of our portfolio managers’ common thinking about these imaginary scenarios and their market effects. The direction of travel is more important than the final point estimate, but still, we hope you will find it as a useful guide to 2026!

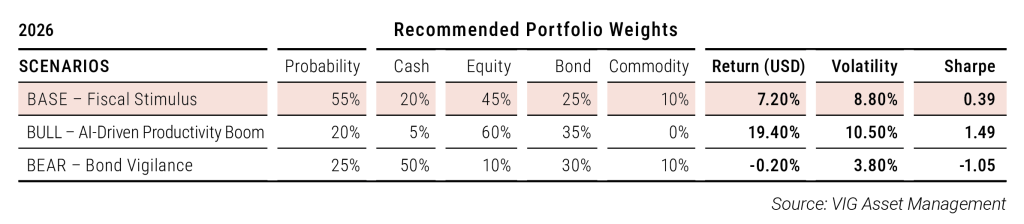

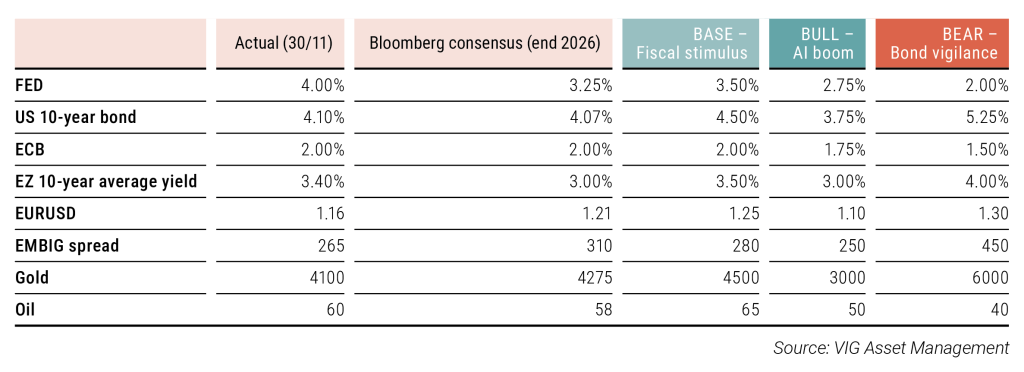

In the summary table, you can find the expected portfolio returns in USD terms which were calculated using our forecasts from the table below. The recommended portfolio weights are arbitrary but represent the most important message: how to position the portfolio if you expect a similar state of the world. At the end of each scenario description, we also present a more detailed, indicative investment fund allocation.

Base scenario (55% probability) – Fiscal stimulus is on the way

In the base scenario we assume the world economy in 2026 will be shaped by forces that were unleashed in 2025 and the macroeconomic backdrop remains broadly supportive for risk assets.

In advanced economies, several factors may support growth. The lagged effect of monetary stimulus and easy financial conditions could play an important part in supporting global growth while fiscal stimuli from Trump’s “one big, beautiful bill” and the German defense and infrastructure package could come to the rescue as well. In the US, fiscal expansion may be front-loaded: after a negative fiscal impulse in the second half of 2025 —exacerbated by the temporary government shutdown — the impulse could turn meaningfully positive next year, already in H1. The extent of planned German spending is significant, but due to implementation risks, positive effects there are more likely to be expected in the second half of the year. Chinese fiscal boost is also on the way as the government tries to spur local consumption in the face of deflationary risks and falling external demand while also focusing on ambitious expansion in strategic sectors and industrial upgrading.

We calculate with the status-quo in trade wars and no big escalation between US and China given the interdependence of the two economies for most of the year but as we approach the mod-term elections Trump’s unpredictability might return. Although the Supreme Court might challenge Trump’s tariffs, probably the administration will find ways to keep the new trade regime intact. We believe most of the disinflation is behind us and better growth prospects will hinder a further big fall in sticky core inflation which will make the probability of further rate cuts by the Fed and ECB lower, but the change of Fed chair in May remains a risk event.

Fixed income

In the Base scenario the Fed may have limited room to cut rates as job market deterioration slows and core inflation remains above target. Eurozone inflation is already on target but the ECB is expected to remain on hold as it assesses the inflationary impact of the fiscal boost. The long end of the curve in the US may remain anchored but macro factors suggest some steepening particularly in Europe. Periphery spreads can tighten as the German fiscal boost is positive for EU growth but disproportionately negative for German bonds amid higher supply. Already tight corporate and emerging market spreads remain stable and provide sufficient carry compensation for investors. In our base scenario, we think it may be worthwhile for investors to keep short duration and look for carry via high yield EM and corporates.

Equities

This fiscal backdrop arrives at a critical moment for corporate fundamentals. In 2025, global EPS growth slightly exceeded 10%, supported disproportionately by US mega-cap tech, whose earnings rose 18%. Excluding these stocks, EPS growth for the rest of the market would have been just 7–8%. In the year ahead, a positive fiscal impulse should broaden the earnings recovery beyond the mega-cap segment, creating a more even distribution of profit growth across sectors and regions. Markets currently expect 12% EPS growth for the MSCI All Country equity index next year, but the recent shift in earnings revisions back into positive territory in the second half may suggest further upside risk.

Given this environment, we expect small and mid-cap equities may outperform after several years of sluggish returns, benefiting from both improved consumer sentiment and more evenly distributed profit growth. Valuations in this segment are particularly attractive: global mid-caps are trading near 30-year relative lows versus the MSCI World (17x forward earnings versus 20x), reflecting an unusually wide valuation gap that leaves room for meaningful catch-up.

The EU stands to benefit as well from this improving global environment. Despite the strong performance of European equities in 2025 – helped in part by USD depreciation – EPS growth in the region remained subdued, and most of the market’s gains were driven by revaluation rather than earnings expansion. In 2026, however, the outlook may be more favourable: increased fiscal support across major EU economies, alongside the gradual fading of tariff-related disruptions, should enable a more meaningful acceleration in earnings. Moreover, European equity markets higher weighting toward real-economy sectors – including industrials, utilities, materials, and financials – positions the region to outperform the main US indices in a year when growth is expected to broaden beyond mega-cap technology.

Our base case still anticipates that AI spending related earnings growth will persist, but high valuations and elevated expectations temper potential gains. Global equities (MSCI All Country World Index) are priced at more than 20 times forward 12-month earnings, around historical highs. A major driver of this rerating has been the rapid expansion of high-growth segments, particularly Information Technology and Communication sectors, whose share of the index has climbed dramatically over the past decade to more than 28%.

The valuation picture is even more demanding in the United States. The S&P 500 trades near 23x expected earnings, placing it close to the upper bound of its historical valuation range. Meanwhile, the Nasdaq’s trailing price-to-earnings ratio – roughly 30x – remains far below the levels seen during the dot-com bubble, yet still reflects a strong degree of confidence. By contrast, markets outside the U.S. look comparatively restrained: European and Chinese indices sit modestly above their 20-year averages, and Japanese equities continue to trade at a discount relative to their longer-term norms.

Overall, the combination of monetary easing, substantial fiscal support, improving consumer dynamics, and broadening earnings growth may form a compelling backdrop for more diversified equity leadership in the coming year. We expect an equity growth of 11% based on our model assumptions, which is slightly below what the earnings growth justifies in 2026.

In the Base Scenario (fiscal stimulus), we expect a 7.2% annual portfolio return denominated in USD with 8.8% volatility. Both equities and commodities may deliver low double-digit returns in this scenario, alongside slightly rising bond yields. We expect flat commodity markets in the base scenario.

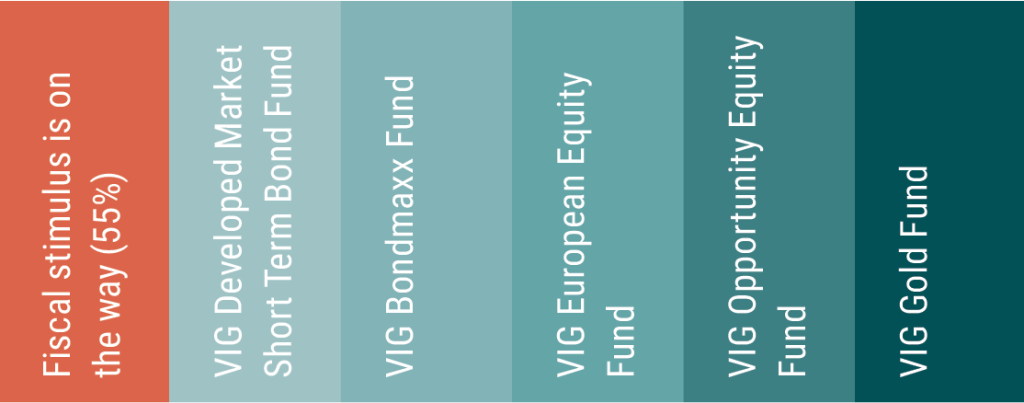

Funds to consider under the Base Scenario:

Bull scenario (20% probability) – AI-driven productivity boom

In this scenario we imagine a perfect world. The results of an AI-driven productivity boom in the US becomes more evident. We assume a faster pace of adoption and a wider diffusion of AI technologies across industries. This may lift growth but in a non-inflationary manner partially through the easing of the labour market and wages driven by discharges from tech companies. Trade tensions fall further as US and China engage in a trade truce. On top of that, Russia’s war in the Ukraine comes to an end – improving consumer confidence in Europe and CEE. In this scenario growth could move to a higher path while inflation may remain subdued, not only due to the help of productivity but also due to falling commodity prices on the back of easing geopolitical tensions. US debt sustainability fears are alleviated as higher potential output helps to outgrow debt.

Fixed income

Despite the positive growth picture, this is not an unfavourable scenario for fixed income. Central banks are able to cut rates as energy prices fall and wages remain well-behaved, which may cause core inflation to moderate. Long yields are less positively affected as breakeven inflation falls but the neutral real rate may move higher. Term premium also falls as macro volatility and debt fears ease. This is the best scenario for spread products as corporate balance sheets improve further and emerging markets could benefit from lower energy prices and less geopolitical and trade tensions. In this scenario overweighting fixed income assets may be the good solution mainly via US government bonds, and emerging market fixed income.

Equities

Jensen Huang, CEO of Nvidia rejected the idea of an “AI bubble” during the company’s latest conference call arguing instead that the industry is at a “tipping point” of structural change. But markets still need more evidence that we are approaching the long-awaited productivity breakthrough. A key question for 2026 is whether AI labs and enterprises can finally turn technological breakthroughs into substantial, dependable revenue streams. It could deliver the long-anticipated second leg of the AI boom, ultimately justifying the massive investments made to date. In this scenario we assume a higher earnings growth of AI related stocks, adding even more significant boost to overall earnings than in 2025.

If the technology sector’s outperformance continues in 2026, the U.S. market is likely to maintain its leadership, just as it did in the second half of 2025. Besides the USA, technology-oriented Asian markets such as Taiwan, South Korea, and China could generate even stronger returns.

Other major upside risk for equity markets would be a more predictable and stabilizing geopolitical and trade environment. The U.S.–China trade truce, stable tariff levels, or an acceleration in Russia–Ukraine peace talks leading to a durable resolution would all help reduce uncertainty. Although markets managed to revalued despite policy and geopolitical uncertainties in 2025, a more predictable global backdrop could lower equity risk premia even further, especially in the CEE region.

In this scenario, we would overweight the U.S. and emerging markets, with a particular preference for Asian and CEE equities. We believe that current equity valuations are not an obstacle to further gains, as accelerating earnings growth and stable interest rates can justify elevated multiples.

In the Bull Scenario (AI-driven Productivity Boom), we expect a 19.4% annual portfolio return in USD terms with 10.5% volatility. Equities are poised to deliver exceptionally strong returns in this environment, alongside with superior bond returns. Conversely, we anticipate that commodity prices could decline significantly in this scenario.

Funds to consider under the Bull Scenario:

Bear scenario (25% probability) – Bond vigilance

Our bear scenario is centered around global debt fears taking centre stage again after only shorter episodes of stress in recent years. Fiscal impulse will not have the desired effect: the growth impulse will be disappointing and limited as low consumer confidence and low fiscal multiplicator of defense spending constrain a more favourable outcome. As this becomes evident, bond market vigilantes do not tolerate higher government bond supply and yields on the long end may rise significantly. Higher yields may act as a negative catalyst for lofty equity market valuations: equity markets fall driven by tech firms. Higher yields and lower equity markets tighten financial conditions and this puts the global economy on a recessionary path which further heats debt fears.

Fixed income

As described above, government bond yields rise across the board. Central banks try to counter recessionary fears and rising yields by cutting rates but they are not successful in anchoring the long end. Emerging market fixed income and global corporate bonds underperform as bond market volatility jumps with spreads widening significantly. We have to admit though that in this scenario the chances of monetary or government intervention aiming to stabilize long end rates (like yield curve control) are high. If this materializes the spike in yields would be short-lived and would be followed by a significant liquidity injection to markets with yields ending up lower and spread products performing very well. But until then it may be advisable to keep the gunpowder dry, overweight cash and short term developed market government bonds.

Equities

In our bear case, the macro backdrop turns less supportive, exposing the fragility of the AI-driven equity rally. A reversal in the rate environment would undermine one of the key pillars that has allowed AI valuations to inflate. While Fed rate cuts and stable long-term yields have helped fuel the AI boom, any sustained increase in borrowing costs could trigger cracks in the AI narrative. This vulnerability is amplified by rapidly rising leverage across the tech sector: hyperscalers have issued more than $120 billion of debt this year, compared with an average of $28 billion over the past five years, while complex financing links involving Nvidia and OpenAI have added to these concerns. Credit spreads have already begun to widen, and a renewed jump in long-term yields could accelerate stress across AI-exposed corporate bond markets.

Equity valuations among AI leaders are pricing near-perfection, with exceptionally low equity risk premia that leave little room for disappointment. In a scenario where yields rise and sentiment shifts, there is substantial downside risk to valuations and a likely repricing of ERP. A bursting of the AI bubble would not remain isolated: the shock could quickly spill over to other tech-linked emerging markets—such as Taiwan, South Korea, and China—and even to AI-dependent industries like utilities, which have benefited from data-center-driven demand expectations. Market participants are heavily concentrated in AI themes as global indices have become increasingly top-heavy. In this environment, the unwinding of AI optimism becomes a broader market event rather than a sector-specific correction.

In this scenario, we see significant downside risks to both earnings and valuations. While it is difficult to predict the precise trigger for an AI-driven bubble to burst, any deterioration in liquidity conditions or renewed concerns over government debt sustainability could create a very different and far more challenging environment for global equities. In such a case, we would underweight equities—particularly in the U.S. and across Asia.

In the Bear Scenario (Bond Vigilance), we expect a –0.2% annual portfolio return in USD terms with 3.8% volatility. As higher bond yields weaken both equity and fixed-income performance, we anticipate mediocre returns across the two main asset classes. Commodity returns are expected to be slightly negative overall; however, we foresee exceptionally strong performance for gold and weak returns for crude oil.

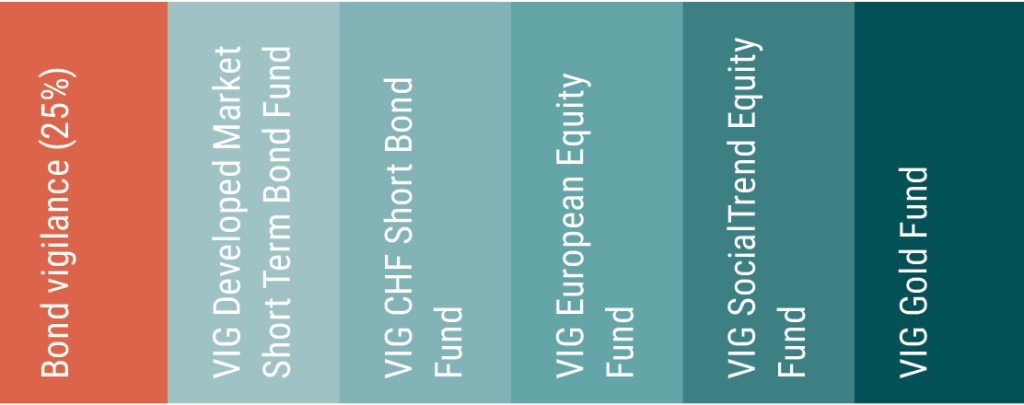

Funds to consider under the Bear Scenario:

Appendix

Appendix 1 – Equity summary

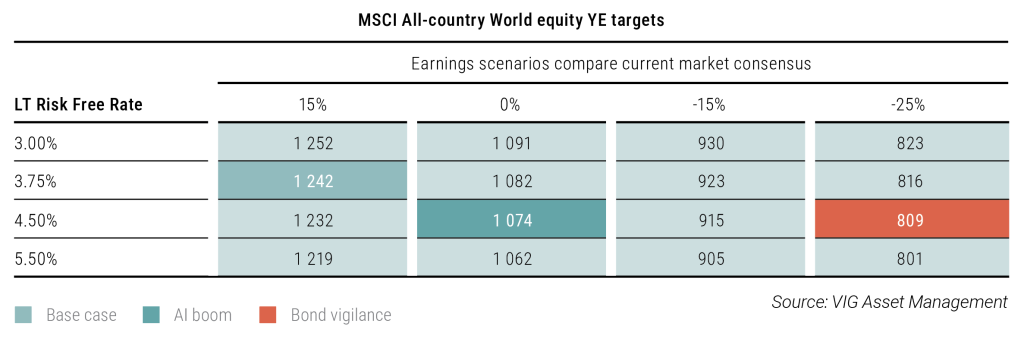

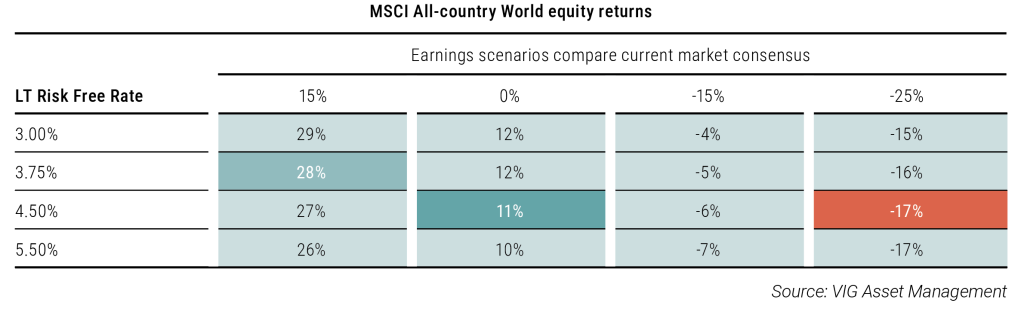

MSCI All Country World sensitivity analysis and year end target returns

Sensitivity based on long term risk free rates and yearly earnings growth compare the current market

consesus. Green field is the AI Boom, Blue field is the Fiscal Stimulus and red field is the Bond Vigilance sceniario.

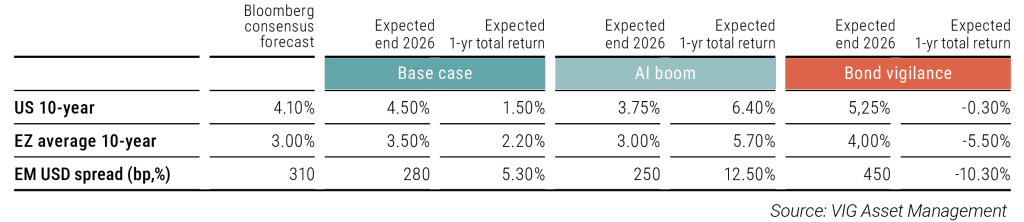

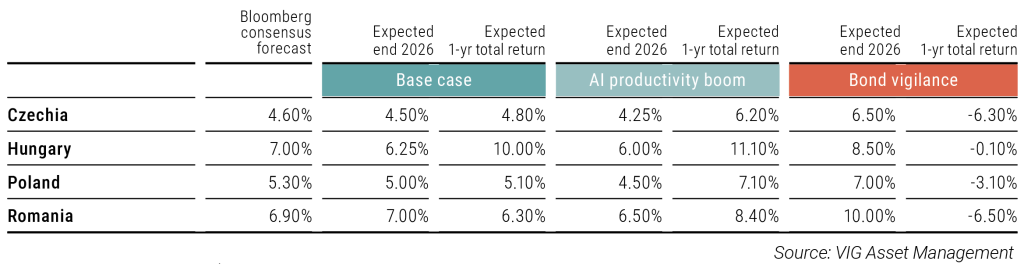

Appendix 2 – Fixed Income summary

Core yields estimates

CEE yields estimates

Macro assumptions

Explore moreInvestment Outlook 2026 Get the publicationDownload

This is a distribution announcement. Detailed information is needed to make a well-founded investment decision. Please inform yourself thoroughly regarding the Fund's investment policy, potential investment risks and distribution in the Fund's key investment information, official prospectus and management regulations available at the Fund's distribution outlets and on the Asset Management's website (www.vigam.hu). The costs related to the distribution of the fund (buying, holding, selling) can be found in the fund's management regulations and at the distribution outlets. Past returns do not predict future performance. Please note that in comparison with other investment funds, the return achieved may be affected by differences in the reference index and therefore the investment policy. The future performance that can be achieved by investing may be subject to tax, and the tax and duty information relating to specific financial instruments and transactions can only be accurately assessed on the basis of the individual circumstances of each investor and may change in the future. It is the responsibility of the investor to inform himself about the tax liability and to make the decision within the limits of the law. The information contained in this leaflet is for informational purposes only and does not constitute an investment recommendation, an offer or investment advice. VIG Asset Management Hungary Closed Company Limited by Shares accepts no liability for any investment decision made on the basis of this information and its consequences.

The Asset Management’s license number for managing alternative investment funds (AIFM) is: H-EN- III-6/2015. The Fund Manager’s license number for UCITS fund management (collective portfolio management) is: H-EN-III-101/2016.