Germany: Economic stagnation meets unprecedented stimulus

Decades of constitutional fiscal restraint served as Germany’s anchor. Yet, as 2025 ends, crisis has shattered this bedrock. Driven by energy costs still 30% above 2021 levels the competitiveness of German industry is in serious jeopardy.

Germany now faces the bill for decades of underinvestment. Obsessed with maintaining rigid fiscal austerity, Berlin ignored eroding infrastructure and industrial modernization. Now, the cost of inaction outweighs the cost of debt, forcing a radical pivot and the government launched a massive, credit-financed overhaul to rebuild the nation’s foundations.

This decision secures the economy’s future but burdens it with a new financial reality. Financing this intervention requires a fundamental restructuring of public finances. Projections indicate that as the government leverages its balance sheet, interest payments will effectively replace fiscal surpluses as a central pillar of the budget.

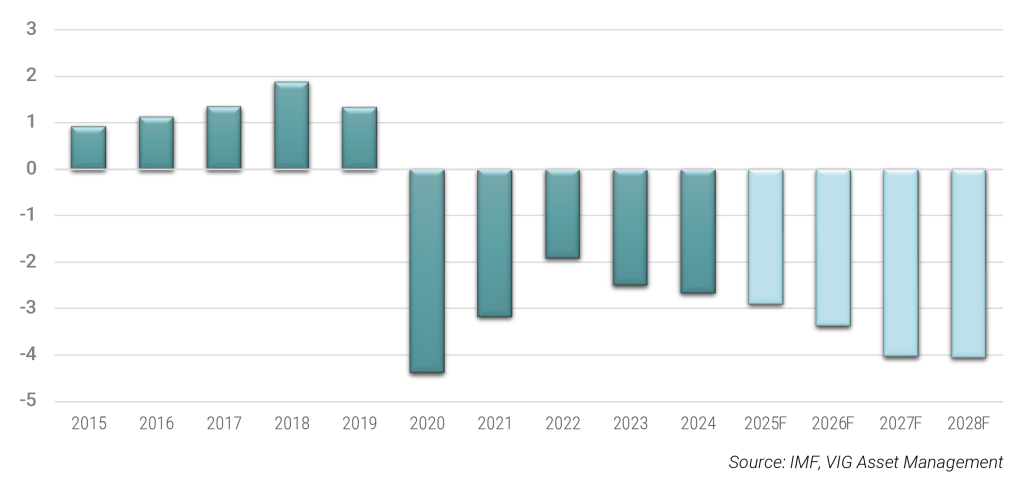

German Budget deficit (%)

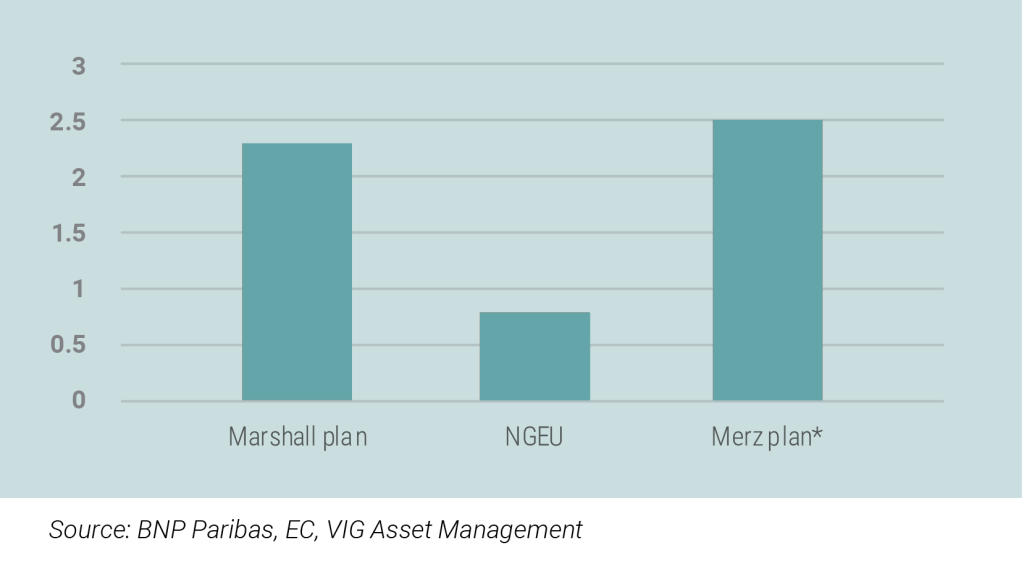

As the chart illustrates, the scale of this shift is staggering. The newly accepted fiscal expansion program effectively mobilises annual resources equivalent to nearly 2.5% of GDP. To put this into perspective, this fiscal impulse greatly surpasses the recent Covid-era NGEU (Next Generation EU) stimulus and even exceeds the relative size of the Marshall Plan, the legendary reconstruction effort that rebuilt West Germany from the rubble of World War II. This capital is not merely for short-term stabilization but is dedicated to a structural transformation of the industrial base. It funnels approximately €500 billion into modernizing physical and digital infrastructure, ranging from rail networks to green energy grids, while simultaneously permanently lifting defence spending to over 2% of GDP to fund domestic rearmament.

Spending as a share of recipient economy GDP per annum (%)

While the legislative framework was established in 2025, the actual economic impact will not be instantaneous. There is a natural lag between passing the budget and deploying the capital. This lag explains why GDP growth is forecast to jump from near stagnation this year to a robust 1.4% in 2026, as record levels of government investment finally hit the real economy.

The cost of this growth is a structural shift in the nation’s finances. Public debt is projected to climb steadily, reaching approximately 67–68% of GDP by 2027, a significant departure from the deleveraging era. Furthermore, the influx of state capital into a labor-constrained market is expected to keep inflation sticky, hovering around or above 2%, as higher wages and construction costs ripple through the economy.

The government’s fiscal pivot is a necessary condition for Germany’s survival, but it is not a guaranteed cure. While the sheer volume of capital will prevent a downward spiral, the “economic miracle” investors hope for faces severe headwinds. The success of this historic shift rests entirely on whether the government can overcome deep labor shortages and a notorious bureaucracy that threatens to bottleneck spending. Without radical deregulation and an influx of skilled workers, the €500 billion fund risks driving up construction costs rather than real industrial output. Also, fiscal multiplier of defence spending will probably be quite low. Ultimately, Germany has bought itself a lifeline to modernize its foundation, but the execution risk remains high, pointing to a slow, difficult recovery rather than a quick bounce back.

Explore moreInvestment Outlook 2026 Get the publicationDownload

This is a distribution announcement. Detailed information is needed to make a well-founded investment decision. Please inform yourself thoroughly regarding the Fund's investment policy, potential investment risks and distribution in the Fund's key investment information, official prospectus and management regulations available at the Fund's distribution outlets and on the Asset Management's website (www.vigam.hu). The costs related to the distribution of the fund (buying, holding, selling) can be found in the fund's management regulations and at the distribution outlets. Past returns do not predict future performance. Please note that in comparison with other investment funds, the return achieved may be affected by differences in the reference index and therefore the investment policy. The future performance that can be achieved by investing may be subject to tax, and the tax and duty information relating to specific financial instruments and transactions can only be accurately assessed on the basis of the individual circumstances of each investor and may change in the future. It is the responsibility of the investor to inform himself about the tax liability and to make the decision within the limits of the law. The information contained in this leaflet is for informational purposes only and does not constitute an investment recommendation, an offer or investment advice. VIG Asset Management Hungary Closed Company Limited by Shares accepts no liability for any investment decision made on the basis of this information and its consequences.

The Asset Management’s license number for managing alternative investment funds (AIFM) is: H-EN- III-6/2015. The Fund Manager’s license number for UCITS fund management (collective portfolio management) is: H-EN-III-101/2016.