Emerging Markets: Strong 2025 performance sets the stage for a promising 2026

Emerging markets delivered a strong performance in 2025, and a closer look at the underlying economic and structural drivers suggests that the outlook for 2026 remains favourable.

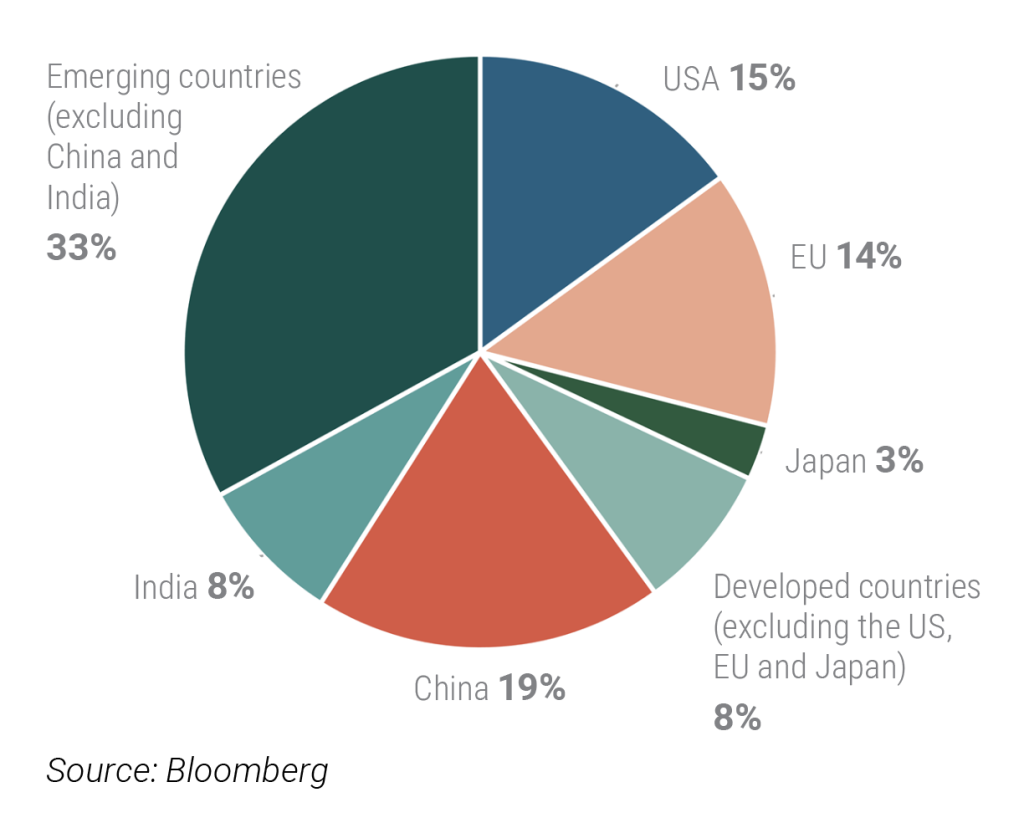

The geopolitical and economic weight of developing countries continues to rise, supported by long-term trends such as demographics, age structure, urbanisation, institutional reform, and the gradual liberalisation of capital-market regulation. On a purchasing-power-parity basis, emerging economies already account for more than half of global GDP, and their growth rates consistently outpace those of developed markets.

GDP distribution (PPP) in 2024

The global macro backdrop is likely to remain constructive, and one of the key catalysts for the continued strengthening of emerging-market currencies and assets—U.S. dollar weakness—also appears set to persist into the new year. The structural forces behind the dollar’s decline, particularly the unwinding of long-standing trade imbalances, typically play out over multiple years. The United States’ record-high current-account deficit vis-à-vis emerging markets has built up over two decades, and its normalization would naturally support dollar depreciation and the appreciation of developed-market currencies. Short- and medium-term dynamics reinforce this trend: the impact of the higher U.S. tariff regime and the accelerating Fed rate-cut cycle may both add downward pressure on the dollar. As U.S. labour-market data gradually weakens, the central bank may be forced to ease more aggressively—earlier, more frequently, or in larger increments—than currently expected. Since most emerging markets are already well ahead in their rate-cut cycles, the relative rate differential versus U.S. yields is likely to widen, further enhancing the attractiveness of EM assets.

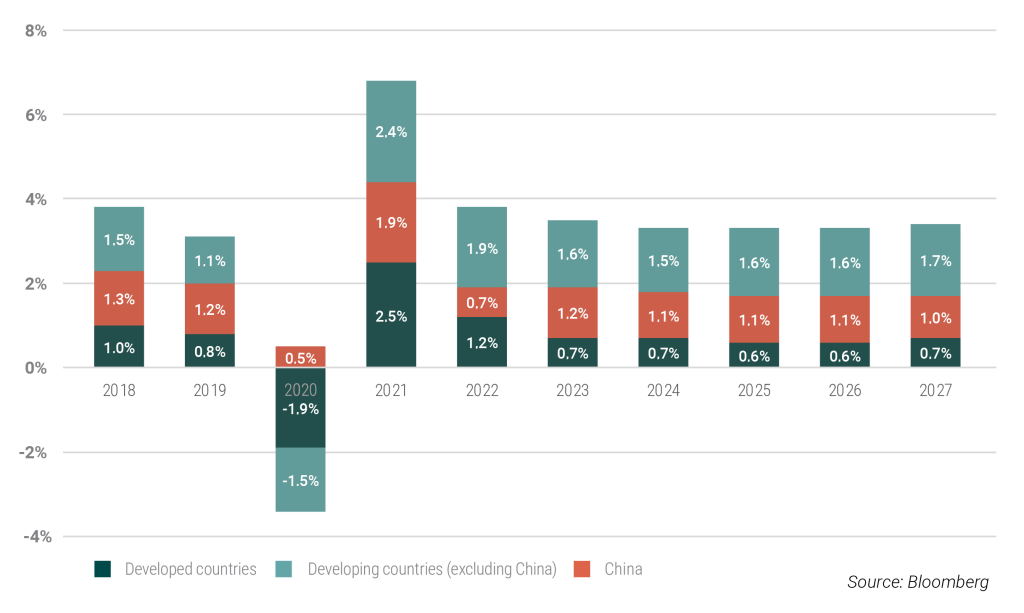

More favourable valuation levels versus developed-market equities continue to support the case for emerging markets, though regional differentiation remains important. Central and Eastern Europe stands out as one of the most attractively valued segments globally, both relative to its own history and compared with other emerging-market regions.

Contribution of emerging countries to global GDP growth

India: A Consolidation Phase Poised to Become a Catch-Up Opportunity in 2026

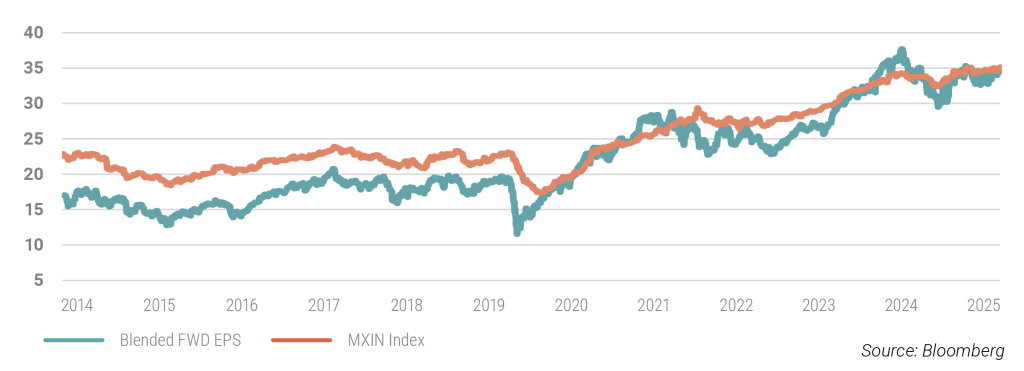

India—the world’s most populous nation and the second-largest emerging-market economy—also deserves special attention. Fiscal stimulus, an increasingly supportive monetary stance, and ongoing structural reforms provide a credible pathway to achieve domestic-demand-driven GDP growth of around 7%. After a multi-year period of outperformance, Indian equities diverged from broader EM trends in 2025, entering a phase of consolidation. The market also failed to match the 5–15% appreciation seen across most developed-market currencies versus the dollar. However, this sideways movement improved equity valuations and helped unwind previous excesses, suggesting that India could be among the noteworthy catch-up stories of 2026.

India – forward EPS (forward-looking earnings per share) and the performance of the MSCI India index (in USD)

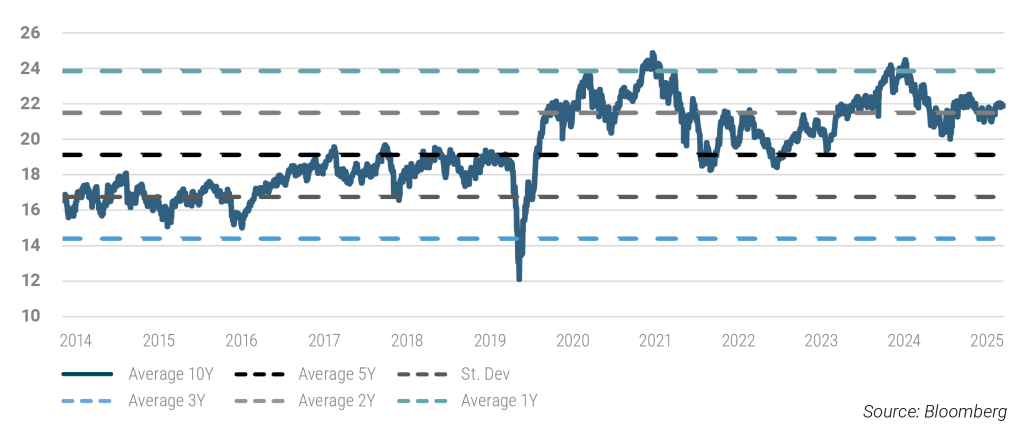

Forward P/E 12m – 12-month forward price/earnings

How to capture the AI trend within emerging markets?

Within the developing world, Taiwan—economically and institutionally closest to advanced markets—serves as the primary technology proxy for emerging markets. Taiwanese equities have historically tracked the performance of the U.S. technology sector, and are likely to remain closely aligned with the global AI megatrend. The dominance of TSMC, which represents roughly 50% of the local index and generates 75% of its revenues in developed markets, underscores this dynamic. As the world’s leading semiconductor foundry and the key supplier to major global technology companies—including, most prominently, Nvidia—Taiwan remains a strategic gateway for gaining exposure to AI-driven growth within the EM universe.

Explore moreInvestment Outlook 2026 Get the publicationDownload

This is a distribution announcement. Detailed information is needed to make a well-founded investment decision. Please inform yourself thoroughly regarding the Fund's investment policy, potential investment risks and distribution in the Fund's key investment information, official prospectus and management regulations available at the Fund's distribution outlets and on the Asset Management's website (www.vigam.hu). The costs related to the distribution of the fund (buying, holding, selling) can be found in the fund's management regulations and at the distribution outlets. Past returns do not predict future performance. Please note that in comparison with other investment funds, the return achieved may be affected by differences in the reference index and therefore the investment policy. The future performance that can be achieved by investing may be subject to tax, and the tax and duty information relating to specific financial instruments and transactions can only be accurately assessed on the basis of the individual circumstances of each investor and may change in the future. It is the responsibility of the investor to inform himself about the tax liability and to make the decision within the limits of the law. The information contained in this leaflet is for informational purposes only and does not constitute an investment recommendation, an offer or investment advice. VIG Asset Management Hungary Closed Company Limited by Shares accepts no liability for any investment decision made on the basis of this information and its consequences.

The Asset Management’s license number for managing alternative investment funds (AIFM) is: H-EN- III-6/2015. The Fund Manager’s license number for UCITS fund management (collective portfolio management) is: H-EN-III-101/2016.