Commodities outlook 2026

In our base-case scenario, most of the global disinflation process is already behind us, and improving growth prospects are set to support commodity demand in 2026.

Under these conditions, a broad-based increase in commodity prices appears likely. In our optimistic scenario, AI-driven productivity gains help keep inflation and energy prices contained, limiting commodity price appreciation with a few key exceptions. Conversely, our pessimistic scenario points to weaker commodity markets, as rising interest rates could push the global economy toward recession, reducing overall demand.

Based on our analysis, three commodity segments stand out in 2026 with the potential for meaningful upside: gold, copper, and agricultural products.

Gold

Gold delivered a spectacular rally of more than 50% in 2025, driven by geopolitical uncertainty, concerns over the sustainability of the U.S. fiscal path, a dovish Federal Reserve, and record levels of central bank buying. The Trump administration’s unpredictable economic policy decisions and explicit preference for a weaker U.S. dollar reinforced this “unorthodox policy mix,” historically known to support gold—similar to previous bull markets anchored in the oil crisis, stagflation, quantitative easing, or the COVID-19 shock.

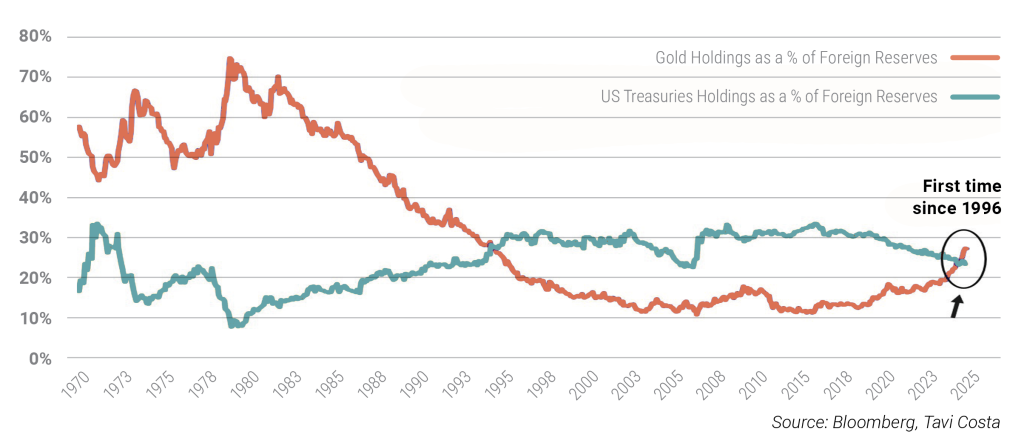

Central-bank reserve diversification is adding a structural tailwind: for the first time in thirty years, foreign central banks now hold more gold than U.S. Treasuries. Meanwhile, retail and institutional portfolios remain underweight in gold, partly due to the post-COVID rise in stock–bond correlations—meaning the asset class is still broadly underowned.

Following the exceptional 2025 rally, the autumn correction was natural and in line with previous bull-market patterns, where sharp pullbacks typically preceded renewed gains. Entering 2026, the fundamental drivers remain in place: elevated global debt levels, a weaker-USD policy stance, deteriorating fiscal outlooks, and a likely Fed rate-cutting cycle. Historically, gold performs particularly well when the Federal Reserve eases policy while inflation remains above 2%.

Overall, while a repeat of the 2025 surge appears unlikely, the macro backdrop continues to suggest meaningful upside potential for gold in 2026.

Foreign central banks hold more gold than treasuries

Copper

Copper is poised to be one of the most interesting commodities in 2026. The rapid expansion of artificial intelligence is triggering an unprecedented wave of data-center construction, placing enormous pressure on global electricity grids. Major economies are not yet prepared for this surge in demand, making large-scale upgrades and modernization of power infrastructure inevitable.

A historical parallel can be drawn to the post-World War II United States: while the electric grid managed the introduction of household appliances in the late 1940s, it collapsed under the widespread adoption of air conditioning in the early 1950s, forcing the country into a decade of grid expansion. The AI revolution may create a similar dynamic today—resulting in a highly supportive demand environment for copper.

Agricultural Products

Agricultural commodities may also present attractive opportunities in 2026. In 2025, China effectively halted purchases of U.S. agricultural goods, severely impacting American farmers and driving many into bankruptcy. As 2026 is an election year in the United States, the Trump administration is expected to make significant efforts to secure Republican control of both chambers of Congress. This places particular political emphasis on agricultural states, where restoring Chinese demand for U.S. soybeans, corn and wheat may be crucial.

If U.S.–China trade in agricultural goods resumes, it could trigger substantial price increases—creating favourable return prospects for investors in this segment.

Explore moreInvestment Outlook 2026 Get the publicationDownload

This is a distribution announcement. Detailed information is needed to make a well-founded investment decision. Please inform yourself thoroughly regarding the Fund's investment policy, potential investment risks and distribution in the Fund's key investment information, official prospectus and management regulations available at the Fund's distribution outlets and on the Asset Management's website (www.vigam.hu). The costs related to the distribution of the fund (buying, holding, selling) can be found in the fund's management regulations and at the distribution outlets. Past returns do not predict future performance. Please note that in comparison with other investment funds, the return achieved may be affected by differences in the reference index and therefore the investment policy. The future performance that can be achieved by investing may be subject to tax, and the tax and duty information relating to specific financial instruments and transactions can only be accurately assessed on the basis of the individual circumstances of each investor and may change in the future. It is the responsibility of the investor to inform himself about the tax liability and to make the decision within the limits of the law. The information contained in this leaflet is for informational purposes only and does not constitute an investment recommendation, an offer or investment advice. VIG Asset Management Hungary Closed Company Limited by Shares accepts no liability for any investment decision made on the basis of this information and its consequences.

The Asset Management’s license number for managing alternative investment funds (AIFM) is: H-EN- III-6/2015. The Fund Manager’s license number for UCITS fund management (collective portfolio management) is: H-EN-III-101/2016.