Central and Eastern European outlook

CEE economies are still waiting for the tide to turn, hoping geopolitical tensions will ease and growth can resume.

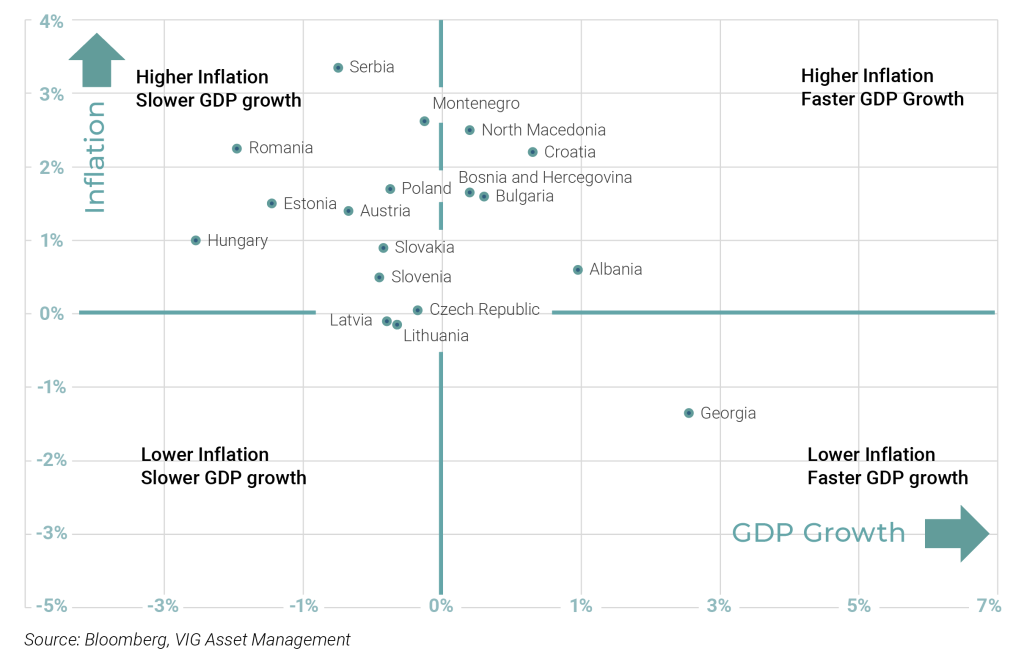

CEE GDP Growth

The CEE region remains in a prolonged holding pattern, with economic growth still significantly weaker than in the years before the pandemic and the war. Inflation – though moderating – is materially higher than pre-crisis norms, while fiscal positions have deteriorated sharply as governments absorbed successive shocks. Policymakers, businesses, and investors are acutely aware that the region is operating below potential, effectively waiting for the tide to turn. A lasting return of peace would not only help the dust settle but could also unlock a meaningful improvement across key macroeconomic indicators – from stronger growth and more anchored inflation to a gradual repair of budget balances.

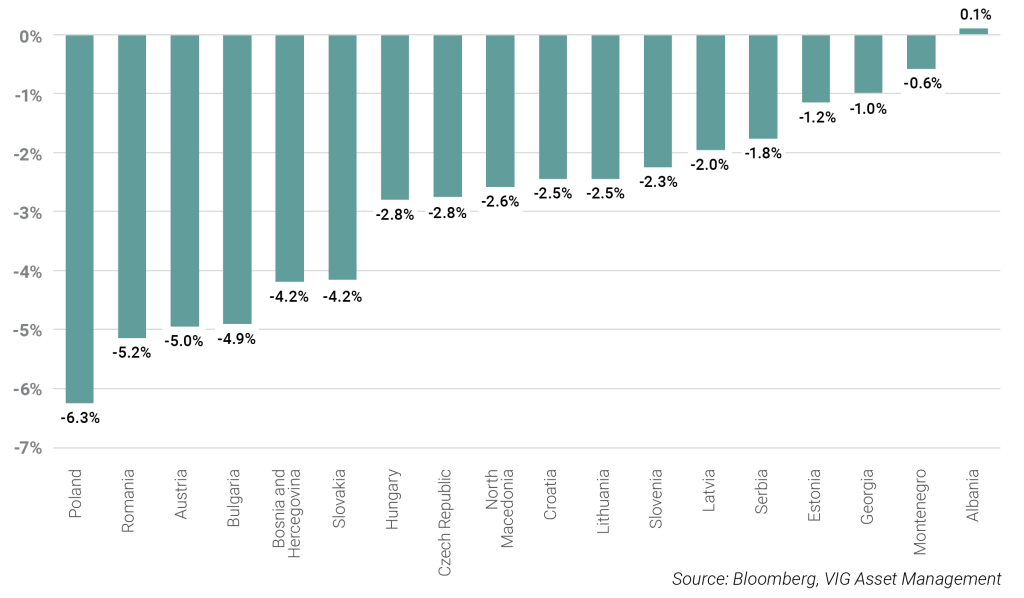

GDP Growth and CPI difference compared to pre COVID/war period (2025/24 avg vs 2019/18 avg)

While the CEE countries’ counter-cyclical policy responses helped them exit the COVID-induced recession, they—along with the shockwaves from the Russia–Ukraine war—failed to generate the degree of growth that had been hoped for. At the same time, fiscal deficits remained elevated, weighed down by weaker post-crisis growth dynamics and persistently higher inflation. In many cases, it has also proven difficult for economic policy to step back from the high levels of spending deployed during successive crises. As a result, macroeconomic equilibrium has yet to be restored in most economies, and the additional burden of rising defence expenditures continues to strain public finances.

Fiscal balance deterioration post-crisis vs. pre-crisis (2024-25 avg. vs 2018-19 avg)

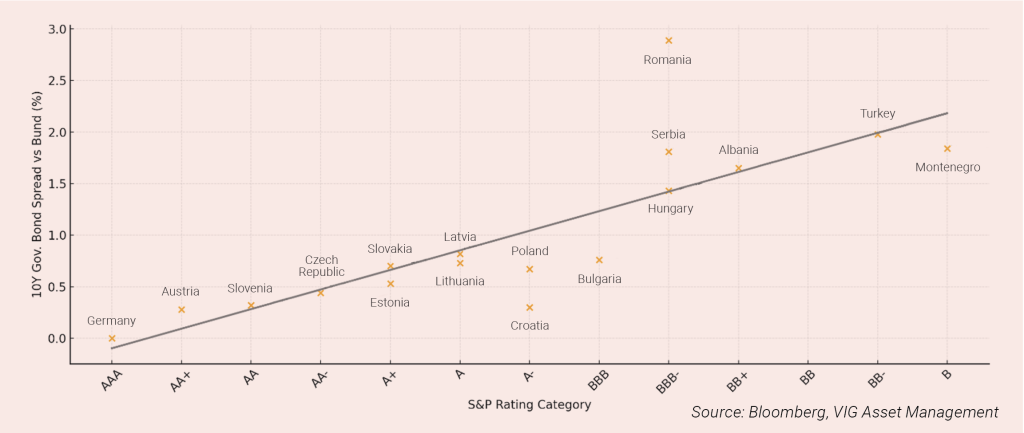

CEE government bonds

Regional sovereign spreads increasingly reflect the mounting burdens on public finances across several CEE economies. While there remains a broadly linear relationship between credit ratings and 10-year yield differentials, a number of countries stand out meaningfully from the trend. Romania, rated BBB–, trades with a spread of nearly 300 basis points—substantially wider than peers in the same rating bucket—indicating the market’s clear pricing of elevated political and fiscal risks, as well as the possibility of further downgrades; from a yield perspective, however, it offers one of the most notable carry opportunities in the region. Hungary and Serbia, both rated BBB–, also pay a sizeable premium of 140–180 basis points, reflecting a persistent political and fiscal risk premium. In a gradually stabilising macro environment, these spreads could become increasingly attractive for investors willing to take moderate risk.

Sovereign credit rating vs 10Y bond spread (with trendline)

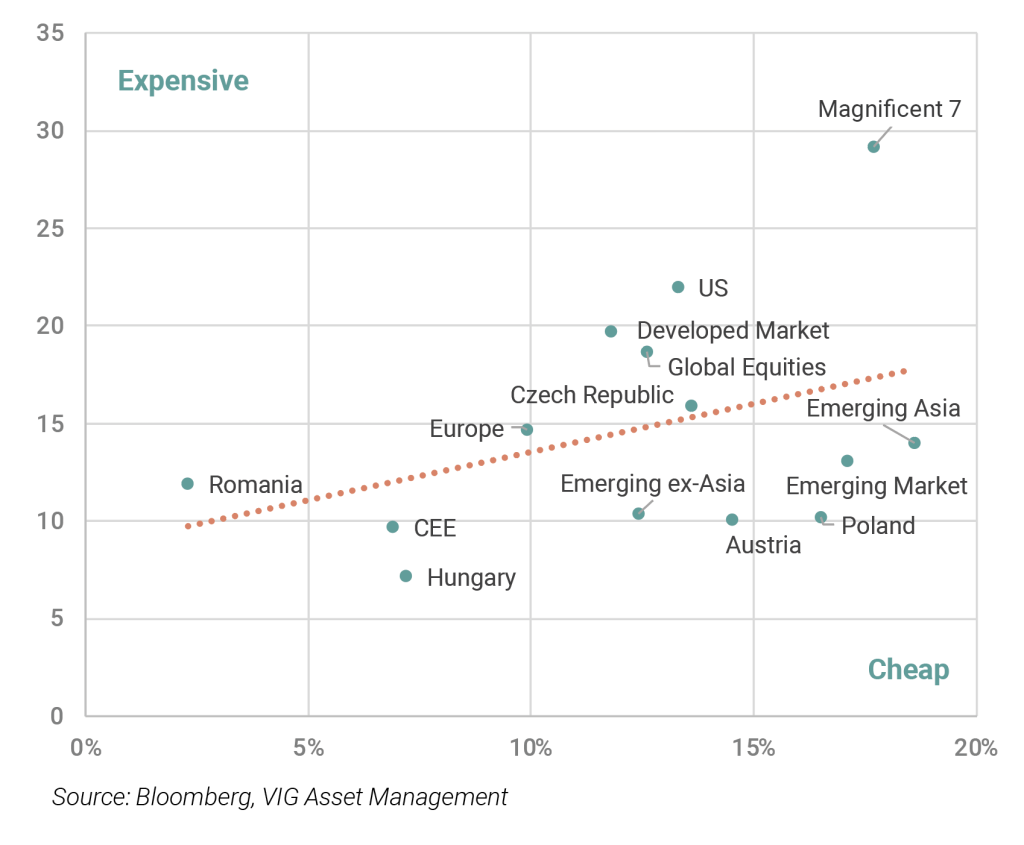

CEE Equities

Global equity markets delivered exceptionally strong returns in 2025, and a continuation of this performance increasingly depends on the materialisation of more optimistic macro and earnings scenarios. As Benjamin Graham famously noted, long-term equity performance is driven primarily by dividend income and the trajectory of corporate earnings, though market valuation—such as the price-to-earnings (P/E) ratio of a listed company—also plays a critical role over extended horizons. On a P/E basis, most major equity markets now screen as expensive, with valuations in several regions sitting well above long-term averages, particularly in technology segments linked to artificial intelligence. A notable exception is the CEE equity market, where still single-digit P/E multiples remain below their 10-year norms, offering an attractive entry point. This is reinforced by the fact that earnings prospects for CEE corporates remain broadly favourable, further enhancing the region’s investment appeal.

CETOP index forward P/E 12M

Although CEE equities are no longer as cheap relative to their own history—the war-related discount has largely faded—they continue to trade at a meaningful valuation discount compared with both developed and other emerging markets. While expected EPS growth for next year is currently the lowest in the CEE region, analysts have continuously revised their 2025 earnings forecasts upward across Czech, Polish, Hungarian, Austrian and Romanian corporates. As noted earlier, GDP growth across CEE remains below pre-crisis levels, and an eventual end to the war would likely support the broader economic environment and, by extension, corporate profitability. This combination suggests that the region still offers considerable upside potential for investors positioned in CEE equity markets.

Market valuation (BF P/E) and EPS growth

Explore moreInvestment Outlook 2026 Get the publicationDownload

This is a distribution announcement. Detailed information is needed to make a well-founded investment decision. Please inform yourself thoroughly regarding the Fund's investment policy, potential investment risks and distribution in the Fund's key investment information, official prospectus and management regulations available at the Fund's distribution outlets and on the Asset Management's website (www.vigam.hu). The costs related to the distribution of the fund (buying, holding, selling) can be found in the fund's management regulations and at the distribution outlets. Past returns do not predict future performance. Please note that in comparison with other investment funds, the return achieved may be affected by differences in the reference index and therefore the investment policy. The future performance that can be achieved by investing may be subject to tax, and the tax and duty information relating to specific financial instruments and transactions can only be accurately assessed on the basis of the individual circumstances of each investor and may change in the future. It is the responsibility of the investor to inform himself about the tax liability and to make the decision within the limits of the law. The information contained in this leaflet is for informational purposes only and does not constitute an investment recommendation, an offer or investment advice. VIG Asset Management Hungary Closed Company Limited by Shares accepts no liability for any investment decision made on the basis of this information and its consequences.

The Asset Management’s license number for managing alternative investment funds (AIFM) is: H-EN- III-6/2015. The Fund Manager’s license number for UCITS fund management (collective portfolio management) is: H-EN-III-101/2016.