The AI era’s hidden winners: Why utilities and power grid are becoming prime investment targets

A few months ago, Elon Musk, Tesla’s founder, noted in an interview that the explosive growth of artificial intelligence (AI) faces three major constraints. “A year ago the bottleneck was chips; the next shortage will be high-voltage transformers. After that, it will be electricity itself. There simply won’t be enough power to run every chip.”

He may be right again. By October, the MSCI World Index – which tracks developed equity markets globally – had gained more than 16% in USD terms. In the golden age of AI-related capex, one might assume IT or Communication Services led the way.

Not so. Year-to-date, utilities have been the top performers: across developed markets, the sector rose roughly 26% between early January 2025 and October 15. A new megatrend is taking shape. It’s no coincidence that our VIG MegaTrend Equity Fund has more than 10% exposure to electrification; this theme has been a major contributor to the fund’s benchmark-beating returns this year.

Power-hungry data centers

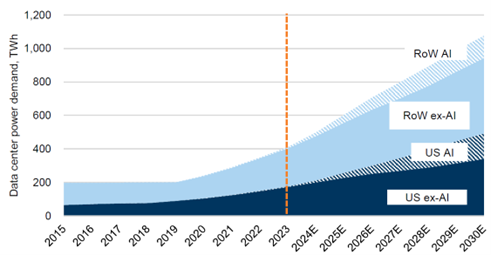

AI’s rise and the proliferation of hyperscale data centers mark not only a technological revolution but an energy inflection point. Surging demand from AI and cloud computing is driving electricity consumption to unprecedented levels. According to Goldman Sachs, data-center power demand could increase by more than 160% by 2030 versus 2023; if data centers were a country, they would rank among the world’s top ten electricity consumers. Globally, data centers already consume more electricity than France and the UK combined, and over the next decade they could approach Russia’s or India’s total usage.

AI is the growth engine: running generative models (e.g., ChatGPT, text-to-video systems like Sora, or Google’s Gemini) requires massive compute, which in turn consumes far more energy than traditional cloud workloads. Beyond raw compute, data centers need continuous, high-voltage power-an entirely new challenge for electric grids. NVIDIA’s latest Blackwell GPUs, for example, more than double the energy draw of prior generations while delivering up to 15× the compute.

Goldman Sachs estimates that by 2030, data centers could account for roughly 3-4% of global electricity consumption, up from 1-2% in 2023. In the U.S., McKinsey projects data-center demand rising from ~25 GW today to over 80 GW by 2030, potentially 11-12% of national electricity use versus 3-4% now. This creates a “chain reaction” across transmission and distribution (T&D), grid-scale storage, and broader infrastructure build-outs.

Global Data-Center Power Consumption

Source: Goldman Sachs

Aging Grid Infrastructure

AI and digitalization’s energy appetite is arriving just as U.S. and European grids are 40-50 years old. The U.S. grid was largely built for simpler, lower loads; much of today’s Western infrastructure can’t keep pace with the surge in demand. Decades of under-investment point to a multi-decade capex cycle. In the U.S. alone, cumulative grid investment exceeding $700 billion is expected by 2030. Required upgrades go well beyond new lines: they include advanced control systems, smart metering, and the integration of storage.

Europe, after ~15 years of flat electricity demand, is turning a corner: European utilities report connection requests from data centers totaling ~170 GW – roughly one-third of the continent’s current consumption. Some observers call this the “renaissance of electric infrastructure.” The grid is no longer a mere utility – it’s the beating heart of the digital economy. Without it, AI, defense, and e-mobility cannot function.

Historically, utilities were seen as defensive, low-growth. Today, structural change is pulling the sector back into the investment spotlight. Meeting rising demand requires modernizing and expanding aging networks. Companies positioned along this value chain can benefit from grid upgrades, renewable integration, and data-center power needs.

| Category | Company | Investment Rationale |

| Infrastructure & Grid Construction | Quanta Services | The largest U.S. grid contractor; a direct beneficiary of the ~$720bn in grid capex. |

| Energy Automation | ABB, Schneider Electric | Smart distribution networks, industrial digitalization, data-center controls. |

| Smart-Grid Technology | Siemens AG | Integrated software-plus-hardware for grid management. |

| Energy & Grid Technology | GE Vernova | Broad energy-infrastructure portfolio (gas turbines, renewables, grid equipment, grid software); a prime winner from grid modernization and AI-driven energy digitalization. |

| Renewables & Storage | NextEra Energy, Sempra Energy | Solar/wind integration, storage, and distribution-network expansion. |

Why This Looks Structural – Not Cyclical

- Durable demand from AI and electrification: Generative AI, cloud, and e-mobility represent decade-long shifts, not fads. Power demand is set to grow persistently, and grids must follow.

- Long-lived infrastructure: New transmission lines, substations, and distribution networks have 40-60-year lifespans, supporting stable cash flows and inflation-resilient revenues for investors.

- National-security relevance: As AI and data-driven defense mature, governments cannot afford grid shortfalls. This elevates political priority and unlocks public funding. (NATO members’ 5%-of-GDP defense-spending commitment includes ~1.5% earmarked for security-related infrastructure.)

Investment Takeaway

The grid ecosystem may be among the most stable yet highest-potential long-term opportunities of the next decade. Demand is propelled simultaneously by the energy transition, datacenter and AI expansion, and the imperative of energy security and reliability.

In the AI age, electric networks and utilities are the invisible backbone. The convergence of data centers, renewables, and grid reliability is igniting a multi-decade capex cycle – one in which infrastructure builders, energy-technology leaders, and regulated utilities can be the standout winners. The digital economy is only as strong as the grid that powers it. Investing in the grid today is, in effect, investing in the future of AI and clean energy.

Legal Notice: The operator of this blog is VIG Asset Management Hungary and the authors are employees of the Asset Management Company. This website contains commercial communication. The articles published on the blog reflect the subjective opinions of private individuals, are prepared for informational purposes only, and do not constitute investment analysis or investment advice, nor do they contain any investment recommendations. The authors of the blog may trade in their own name in financial instruments, funds, or other products about which they provide information or express an opinion in their articles. While the authors’ experience gained in stock exchange or over-the-counter trading may be reflected in their writings on this blog, such interests must not influence the information they provide. Articles, news, and information on the blog may feature companies that maintain business relations with VIG Asset Management Hungary or with the authors of the blog, either directly or through another company belonging to the VIG Group. The articles published on this blog do not provide complete information and do not replace the assessment of the suitability of an investment, which can only be determined by evaluating the individual circumstances of the given investor. To make a well-founded investment decision, please seek detailed information from multiple sources.

VIG Asset Management Hungary, the editors, and the authors of the blog accept no responsibility for the timeliness, possible omissions, or inaccuracies of the content on the blog, nor for any investment decisions made on the basis of the blog articles, or for any direct or indirect damage or cost arising from such investment decisions.