The New Golden Age of Video Gaming

Market Outlook, Key Trends, and Growth Drivers

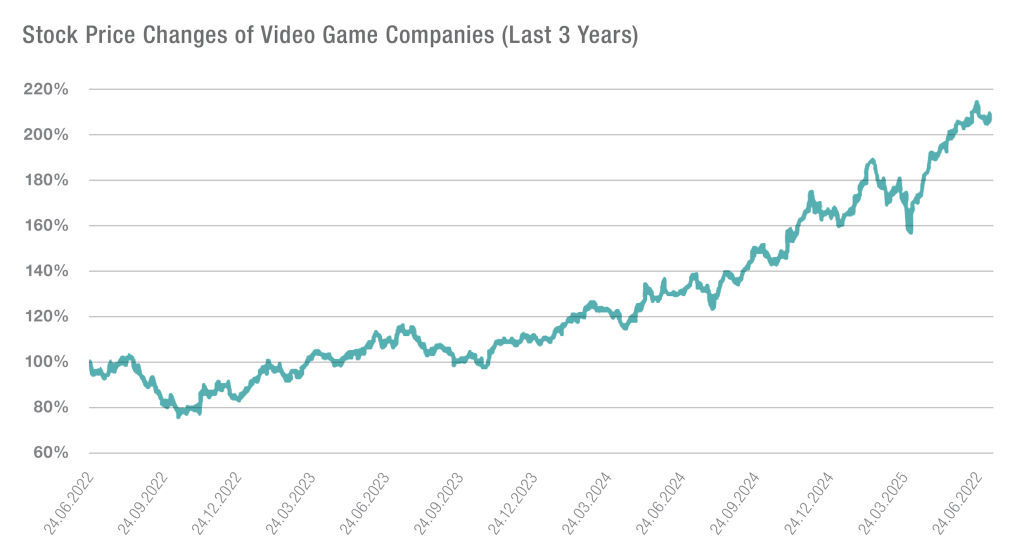

One of the best-performing megatrends of the year has been tied to the companies behind video game development. But what’s driving this surge?

The world of video games has long since outgrown its traditional role as a niche entertainment sector. Today, it stands as a dominant, diverse, and increasingly investor-friendly global industry. In 2024, the global gaming market even surpassed total spending on professional sports. Following the explosive growth during the COVID-19 era, the sector appears to be entering another inflection point—fueled by breakthrough technologies (especially artificial intelligence), next-gen consoles, and a wave of long-anticipated major game releases. In the coming years, gaming’s influence will grow not just economically, but culturally as well.

The Main Growth Engines of the Gaming Sector

- The Global Gamer Population Could Reach 3 Billion

Although gaming experienced exceptional growth over the past decade, the post-pandemic correction slowed momentum, bringing the industry back to single-digit annual growth. From a 13% average yearly growth between 2017 and 2021, the pace dropped to just 1% by 2023. Future forecasts suggest a more moderate, yet steady, growth of around 5% annually. In 2024, the global gaming market is projected to be worth $221 billion, potentially rising to $266 billion by 2028.

This growth is not only quantitative, but structural and qualitative. The industry is transforming through new platforms, innovative business models, and technological breakthroughs that are redefining how games are developed, distributed, and consumed. By 2029, the global gaming population is expected to reach 3 billion – up 17% compared to 2024.

Source: Bloomber, VIG AM

- Cloud Gaming to Grow 25% Annually

Generative AI has ushered in a new era for gaming. AI doesn’t just personalize gameplay – it significantly reduces development costs and timelines. What once took years can now be prototyped in weeks. Automation and creative AI tools empower even small studios to release competitive products swiftly.

Meanwhile, the cloud gaming segment is expected to grow at a 25% annual rate, reaching $25 billion by 2029. Cloud infrastructure enables high-quality gaming regardless of a user’s hardware, attracting an even broader audience.

- Evolving Business Models

A key shift is the widespread adoption of Gaming-as-a-Service (GaaS) models. Instead of one-time purchases, developers now rely on recurring revenue streams through subscriptions, in-game purchases, and ongoing content updates. This approach offers more predictable and scalable income—even during periods when console sales or new game releases slow down.

- Even Boomers Are Playing All Day

Over 213 million Americans now play games regularly, with the average weekly playtime reaching 12.8 hours. The over-50 age group is also growing rapidly – from just 17% in 2004 to 29% in 2024.

Easing regulations have triggered a new growth cycle in markets like China, where the gaming sector grew by 7.5% in 2024, reaching $44.8 billion. Leading players include NetEase and Tencent. In Japan, the introduction of new hardware – like the Nintendo Switch 2 – is driving momentum. In 2025, Japanese gaming revenue could surpass $51 billion.

- Top Players Report Outstanding Results

Recent hit releases such as Call of Duty: Black Ops 6 and Helldivers II have greatly increased user engagement, helping leading publishers post strong performance in 2025.

- Electronic Arts (EA): Sports games, including EA Sports College Football 25, are among the best-performing segments. EA reported a record $7.35 billion in net bookings in fiscal 2025, with projections reaching $8 billion for 2026.

- Take-Two Interactive: Anticipation for GTA VI is historic. Its first trailer garnered over 475 million views in just 24 hours. GTA V generated over $8 billion in total revenue, making it the most successful entertainment product of all time.

- Sony and Nintendo: New game releases – often accompanied by hardware upgrades – continue to boost the console market, which is expected to grow by 20.9% through 2027. Sony has sold over 78 million PS5 consoles, while demand is rising thanks to exclusive titles. The Nintendo Switch 2 sold 3.5 million units within four days of launch, with a sales target of 15 million units for the 2026 fiscal year.

- Roblox: A prime example of social gaming success, Roblox reached 97.8 million daily active users in Q1 2025 – a 26% YoY increase. Annualized revenue is now over $4 billion, up 29% from the previous year.

Financial Stability, New Challenges, and the Road Ahead

As the market recalibrated post-pandemic, gaming companies streamlined operations, cut costs, and increasingly integrated AI tools. As a result, the industry’s financial foundations are more stable than ever. Free cash flow margins have significantly improved thanks to efficiency gains and cost reductions. Gaming is also relatively recession-resilient, with consumers maintaining digital entertainment habits even during economic slowdowns.

Still, challenges remain. The cost of developing AAA titles has outpaced revenue growth. On top of that, the industry faces regulatory, data privacy, consumer protection, and antitrust risksesp – ecially given its global exposure. Maintaining a strong pace of innovation remains critical for sustained growth.

Conclusion

The video game industry is no longer just a branch of the entertainment world—it has become a standalone global ecosystem. Driven by technological advancement, growing cultural acceptance, evolving business models, and regional expansion, gaming is on a growth trajectory that appears sustainable for the long term.

From an investment perspective, this megatrend offers a rare combination of innovation, stability, and resilience across economic cycles – making it one of the foundational pillars of future digital entertainment. This is why the VIG MegaTrend Equity Investment Fund considers the gaming sector a key component of its portfolio.

Source: GlobalX Insights; BCG, The Future of Global Gaming Industry; BCG, The gaming report

VIG MegaTrend Equity Investment Fund

The VIG MegaTrend Equity Investment Fund aims to benefit from global megatrends that transcend economic cycles.

These include demographic changes (aging populations, emerging markets), efficiency gains from limited resources (renewable energy, energy efficiency), urbanization, and technological innovation.

The fund is managed by Péter Richter, Senior Equity Portfolio Manager.

“The authors contributing to this blog accept no responsibility for any investment decisions made or for any consequences arising from their articles published on the blog, nor for any potential omissions or inaccuracies in the information provided on the website. The articles appearing on this blog reflect the subjective opinions of private individuals and do not constitute investment analysis or recommendations.”

Legal Notice: The operator of this blog is VIG Asset Management Hungary and the authors are employees of the Asset Management Company. This website contains commercial communication. The articles published on the blog reflect the subjective opinions of private individuals, are prepared for informational purposes only, and do not constitute investment analysis or investment advice, nor do they contain any investment recommendations. The authors of the blog may trade in their own name in financial instruments, funds, or other products about which they provide information or express an opinion in their articles. While the authors’ experience gained in stock exchange or over-the-counter trading may be reflected in their writings on this blog, such interests must not influence the information they provide. Articles, news, and information on the blog may feature companies that maintain business relations with VIG Asset Management Hungary or with the authors of the blog, either directly or through another company belonging to the VIG Group. The articles published on this blog do not provide complete information and do not replace the assessment of the suitability of an investment, which can only be determined by evaluating the individual circumstances of the given investor. To make a well-founded investment decision, please seek detailed information from multiple sources.

VIG Asset Management Hungary, the editors, and the authors of the blog accept no responsibility for the timeliness, possible omissions, or inaccuracies of the content on the blog, nor for any investment decisions made on the basis of the blog articles, or for any direct or indirect damage or cost arising from such investment decisions.