The model portfolios have been constructed based on the VIG Investment Clock and our tactical asset allocation strategy, using following principles: we have selected 4-5 investment funds from our own range.

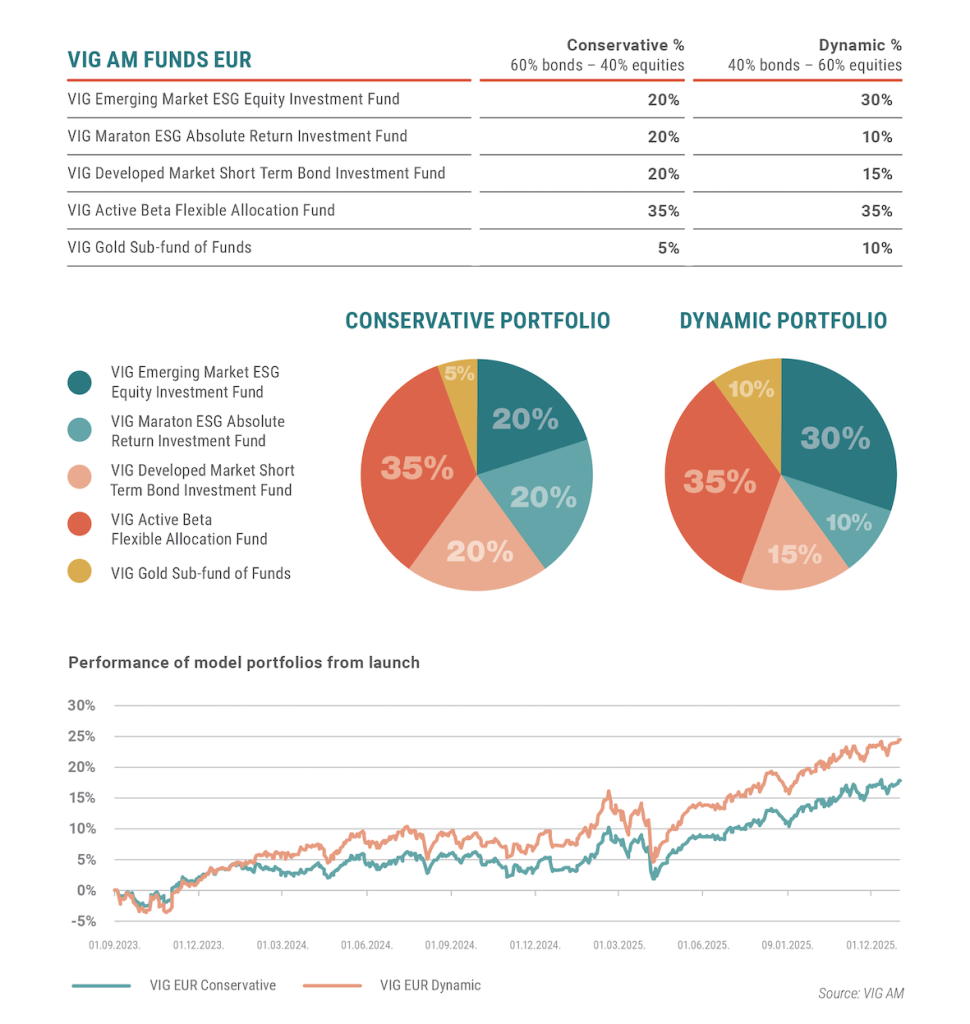

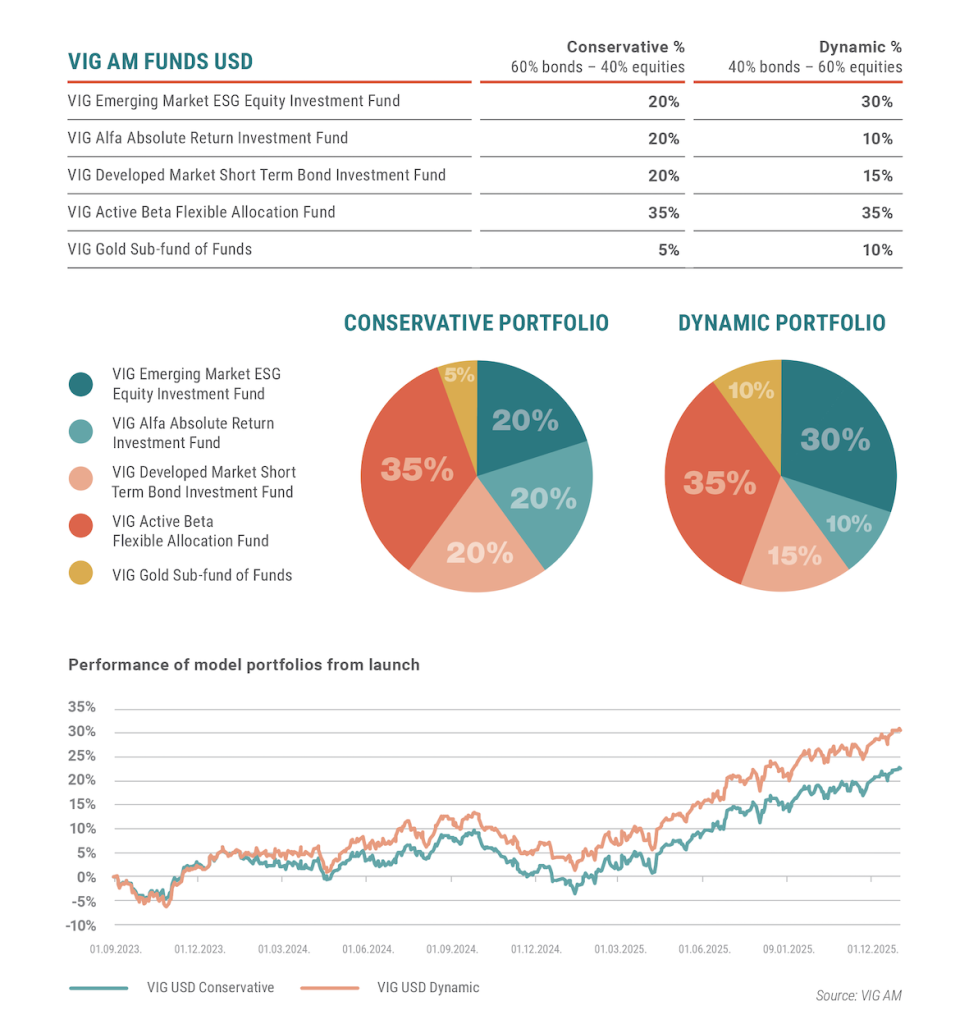

In all three currencies, the Conservative Portfolio targets a composition of 40% equities and 60% bonds, while the Dynamic Portfolio focuses on 60% equities and 40% bonds. The key economic factors behind these allocations include global and regional economic trends, expectations of central bank interest rate cuts, and investor sentiment.

Conservative portfolio focuses more on stability and fixed income assets (bonds), whereas dynamic portfolios aim for higher-yield outlook, using the volatility of equities. ESG considerations remain important, particularly in emerging markets and mixed-asset funds.

Investment Approach

Based on our economic cycle forecasting model – the VIG Investment Clock – growth prospects across the key regions currently remain favourable. The economy appears to be in an upswing phase, which typically provides a supportive environment for equity markets and commodity investments in particular.

Within equities, European stocks arguably offer the most compelling opportunities at present. Stronger fiscal stimulus in major EU economies this year, combined with a gradual easing of tariff-related disruptions, could allow for a meaningful acceleration in corporate earnings growth. In addition, European equity markets have a higher weighting of “real economy” sectors – including industrials, utilities, materials and financials. As a result, the region stands to benefit both from faster growth and from a broadening earnings recovery.

Among equities, bank stocks could be among the strongest performers. Large Italian, Spanish and regional financial institutions – such as UniCredit, Intesa Sanpaolo, Erste and OTP – may benefit from the region’s dynamic economic growth and from still-attractive, accessible lending margins.

A recovery-driven economic cycle is less supportive for bond markets. When growth is strong, central banks have less incentive to cut interest rates, limiting the potential for significant bond price appreciation. In Hungary, risks surrounding government bonds – previously favoured by investors due to high real yields – are also increasing as the spring parliamentary elections approach. A possible, and not implausible, bout of pre-election fiscal spending could materially raise government expenditures and widen the budget deficit, potentially undermining investor confidence and putting downward pressure on government bond prices.

VIG EUR Portfolios

In line with prevailing market trends, we have adjusted the allocation of our euro-denominated model portfolio. To take advantage of the opportunities created by rising investor risk appetite, we reduced the weight of the VIG Developed Market Short Term Bond Investment Fund.

The capital freed up through this adjustment was reallocated – similarly to our forint-denominated model portfolio – into the VIG Active Beta Flexible Allocation Fund. As outlined earlier, this fund has significant exposure both to leading European equity markets – with the “old continent” potentially emerging as one of the standout equity stories of 2026 – and to artificial intelligence-related stocks, which have been among investors’ preferred themes in recent years.

VIG USD Portfolios

We implemented similar tactical allocation changes in our U.S. dollar–denominated model portfolio as in the euro-based version.

Within the higher-risk, return-seeking “Dynamic” allocation, we once again increased the weight of the VIG Active Beta Flexible Allocation Fund in order to further enhance return potential. The fund invests in the most popular U.S. and European listed equities while applying a disciplined and robust risk-management framework, focusing on companies with the strongest market narratives and media attention.

At the same time, we reduced the allocation to the VIG Developed Markets Short Term Bond Investment Fund, reflecting the weakening global outlook for bond markets.

Disclaimer

This is a distribution announcement. Detailed information is needed to make a well-founded investment decision. Please inform yourself thoroughly regarding the Fund’s investment policy, potential investment risks and distribution in the Fund’s key investment information, official prospectus and management regulations available at the Fund’s distribution outlets and on the Asset Management’s website (www.vigam.hu). The costs related to the distribution of the fund (buying, holding, selling) can be found in the fund’s management regulations and at the distribution outlets. Past returns do not predict future performance. Please note that in comparison with other investment funds, the return achieved may be affected by differences in the reference index and therefore the investment policy.

The future performance that can be achieved by investing may be subject to tax, and the tax and duty information relating to specific financial instruments and transactions can only be accurately assessed on the basis of the individual circumstances of each investor and may change in the future. It is the responsibility of the investor to inform himself about the tax liability and to make the decision within the limits of the law.

The information contained in this leaflet is for informational purposes only and does not constitute an investment recommendation, an offer or investment advice. VIG Asset Management Hungary Closed Company Limited by Shares accepts no liability for any investment decision made on the basis of this information and its consequences.

The Asset Management’s license number for managing alternative investment funds (AIFM) is: H-EN-III-6/2015. The Fund Manager’s license number for UCITS fund management (collective portfolio management) is: H-EN-III-101/2016.