AI Capex- AI investment boom: overheated market or the dawn of a new infrastructure era

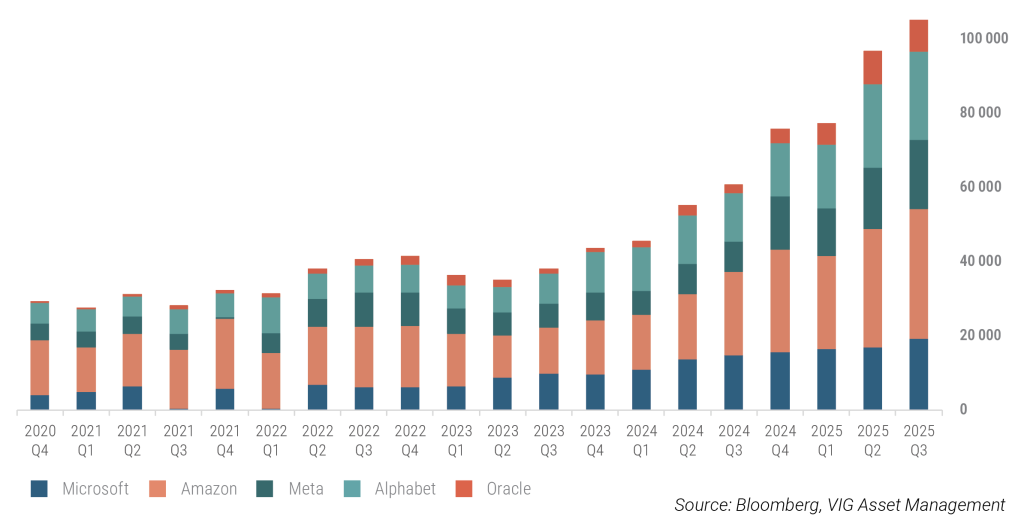

The artificial intelligence boom of recent years has been fueled by the data center investments of hyperscaler companies – Amazon.com Inc., Alphabet Inc., Meta Platforms Inc., Microsoft Corporation, and Oracle Corporation – and their latest earnings results have once again confirmed the accelerating pace of the AI race.

Hyperscalers are the largest operators of IT infrastructure globally: technology giants that run hundreds or even thousands of data centers across multiple continents, providing cloud services, AI compute capacity, storage, and processing power. All major hyperscalers have raised their capital expenditure forecasts for 2026. At the beginning of 2024 and 2025, consensus expectations pointed to roughly 20% annual capex growth. In reality, capex growth exceeded 50% in both years. As we approach 2026, analysts now forecast 34% capex growth—up from the 20% projected at the start of the third quarter. This implies that AI investments could reach as much as $533 billion next year, compared with roughly $400 billion in 2025 and $237 billion in 2024.

Hyperscalers quarterly capex (million USD)

The hyperscaler capital expenditure cycle is the primary driver of AI development. However, concerns about a potential AI bubble have begun to intensify as the valuations of many AI-exposed companies have surged, the buildout of AI infrastructure is attracting investment on a historic scale, and the ecosystem is becoming increasingly circular in nature.

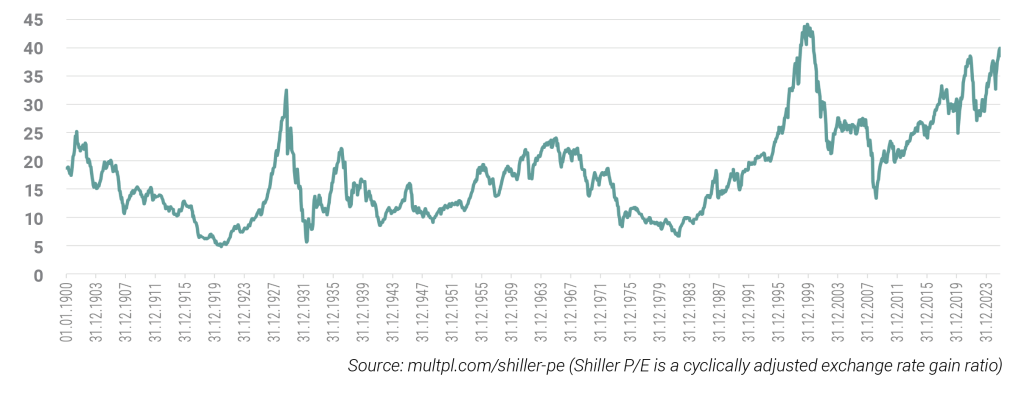

Cyclically-adjusted price earnings ratio S&P500 Index

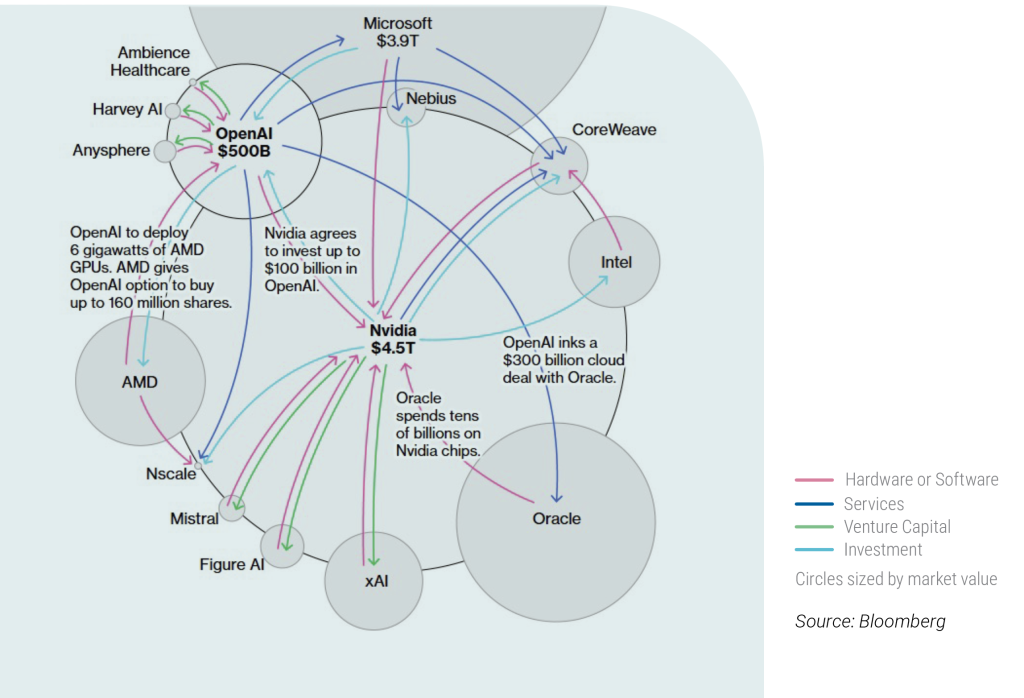

Nvidia, OpenAI and several other technology giants are fueling the AI investment boom through circular, mutually reinforcing partnerships that already move hundreds of billions of dollars and could collectively reach the trillion-dollar scale. In these arrangements, companies simultaneously act as investors, suppliers, and customers. The essence of the phenomenon is that the same players are both giving and receiving money: one company invests in another, which then spends that capital on services or equipment purchased from the very same investor. As a result, the money effectively circulates within the system—creating the appearance of sustained growth, even though the actual economic return materializes far more slowly. This tightly interlinked business network increasingly resembles the excesses of the dot-com era, especially because the underlying AI technologies’ monetization and profitability currently lag well behind the pace of investment.

An increasingly circular AI ecosystem

In this increasingly circular financing system, OpenAI is also an indispensable player. The key difference between the ChatGPT operator and the major hyperscalers, however, is that the latter have stable, well-established business models that have generated profits for many years. OpenAI, by contrast, expects to burn a total of $115 billion in cash by 2029.

While the hyperscalers have funded the majority of their capex from operating cash flows, these companies also have substantial debt-raising capacity, and in recent years they have increasingly turned to debt financing—opening further room for additional investment. Since 2021, the group’s aggregate net debt (debt minus cash) has risen from –$158 billion to +$137 billion. Despite the $295 billion increase in net debt, their balance sheets remain exceptionally strong: the group’s net debt-to-EBITDA ratio has climbed from –0.7x in early 2021 to only +0.2x today. Most of these companies carry credit ratings at the upper end of the Investment Grade category, with the notable exception of Oracle, whose cost of insuring its debt against default has surged sharply in recent months—marking the largest increase since 2021. CDS (credit default swap) prices typically rise when investor confidence in a company’s credit quality deteriorates.

Oracle 5-year CDS

One of the biggest risks of the current AI investment boom is the increasingly circular network of financing and ownership, which leaves the ecosystem highly vulnerable. If a major hyperscaler were forced to write down a multibillion-dollar data center investment, it could trigger a domino effect across the supply chain. Such a write-down would effectively wipe out the company’s expected growth outlook for the coming years and reveal that a portion of the investment cycle was built on overly optimistic assumptions. This vulnerability is amplified by the fact that hyperscalers still do not generate meaningful profits directly from AI: their massive AI-related capex is being funded by their core, highly profitable businesses (cloud, advertising, e-commerce). If these core segments slow, or if AI projects fail to deliver returns on the expected timeline, the entire capex model could quickly come under pressure. In 2026, a “digestion phase” is likely—meaning a 20–30% slowdown in capex growth after the current surge, as companies will need to test whether these investments actually produce incremental revenue.

In addition, one of the most underestimated yet critical risks of the current AI investment wave is the limitation of power supply. The electricity demand of data centers is rising at a pace that grid capacities in many countries simply cannot keep up with. If the expansion of the power grid lags behind the growth of AI infrastructure, a portion of newly built data centers may end up underutilized. We could reach a point where the bottleneck is no longer the technology itself, but the availability of sufficient energy.

This represents a significant risk because AI currently dominates U.S. equity markets—the market capitalization of a handful of major technology companies accounts for nearly half of the entire market. If this extreme enthusiasm were to fade abruptly, the consequences would extend far beyond Silicon Valley and could undermine the financial stability of the global economy.

In recent months, the term “AI bubble” has become one of the hottest topics in financial markets—so much so that some are now speaking of a “bubble about the AI bubble.” At the same time, market history suggests that such bubbles typically do not burst when skepticism is still widespread, but rather when doubt has all but vanished and everyone is celebrating the technology, seeing it as the sole path to the future.

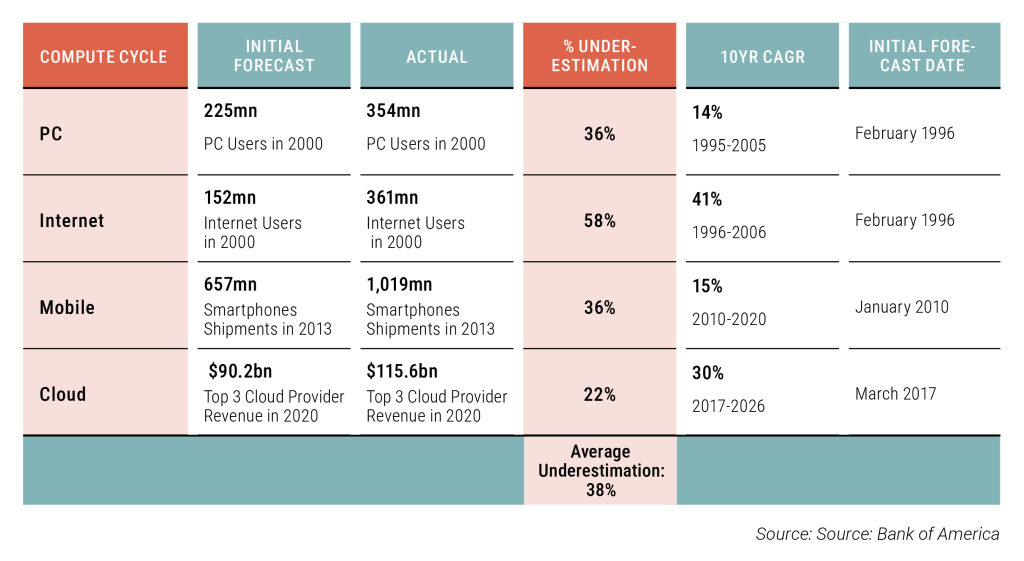

However, it is important to remember that technological progress typically follows a pattern in which we overestimate the impact of a new technology in the short term, yet underestimate its significance over the long term. The history of the internet, the mobile revolution, and cloud computing all illustrate this well: in the late 1990s, the internet promised an immediate transformation but collapsed in the dot-com bust—only to become the backbone of the modern economy years later; the early smartphone era was marked by app euphoria that soon faded, yet mobile technology ultimately became the central platform of digital life; and cloud adoption initially progressed slowly and met with skepticism, but eventually grew into the core of enterprise infrastructure. AI today appears to be following the same trajectory: while the current hype and spending surge may seem excessive in the near term, its long-term potential is likely far deeper and more transformative than what is visible right now—much like in previous technological revolutions.

Underestimation of disruptive technologies over the past decades

Although many consider the current valuation of the Nasdaq to be stretched, it is not entirely accurate to compare today’s environment one-to-one with the late-1990s dot-com era. Today’s wave of technology investments is driven not only by market enthusiasm, but also by geopolitics — the competition among major powers and the race to build strategically important digital infrastructure. This dynamic is more reminiscent of the period when the launch of Sputnik triggered a technological acceleration during the Cold War. The capital flowing into artificial intelligence and digital infrastructure therefore appears less like a short-lived surge and more like the beginning of a deeper, long-term structural transformation.

Overall, AI capex currently carries both bubble-like risks and significant long-term opportunities. Hyperscalers are pouring capital into massive data center projects and chip purchases, yet these investments are not generating meaningful revenue so far, and the increasingly circular financing structures make the ecosystem more fragile. Over the long run, however, the buildout of AI infrastructure could drive genuine economic transformation, much like the internet or cloud services did in previous cycles. After a potential correction of short-term excesses, the rise of AI is expected to create secular demand across several sectors — including software development, data center real estate, optical networks, energy providers, grid expansion, cooling technologies and broader infrastructure hardware — where structural growth, rather than a mere hype cycle, is the dominant outlook.

Explore moreInvestment Outlook 2026 Get the publicationDownload

This is a distribution announcement. Detailed information is needed to make a well-founded investment decision. Please inform yourself thoroughly regarding the Fund's investment policy, potential investment risks and distribution in the Fund's key investment information, official prospectus and management regulations available at the Fund's distribution outlets and on the Asset Management's website (www.vigam.hu). The costs related to the distribution of the fund (buying, holding, selling) can be found in the fund's management regulations and at the distribution outlets. Past returns do not predict future performance. Please note that in comparison with other investment funds, the return achieved may be affected by differences in the reference index and therefore the investment policy. The future performance that can be achieved by investing may be subject to tax, and the tax and duty information relating to specific financial instruments and transactions can only be accurately assessed on the basis of the individual circumstances of each investor and may change in the future. It is the responsibility of the investor to inform himself about the tax liability and to make the decision within the limits of the law. The information contained in this leaflet is for informational purposes only and does not constitute an investment recommendation, an offer or investment advice. VIG Asset Management Hungary Closed Company Limited by Shares accepts no liability for any investment decision made on the basis of this information and its consequences.

The Asset Management’s license number for managing alternative investment funds (AIFM) is: H-EN- III-6/2015. The Fund Manager’s license number for UCITS fund management (collective portfolio management) is: H-EN-III-101/2016.