From AI to Uranium Mines: Megatrends Come of Age

Investors who allocated capital to megatrend-type equities have been well rewarded this year. The VIG MegaTrend Equity Investment Fund, which offers a well-diversified exposure to this segment, delivered a return of nearly 20% in U.S. dollar terms in 2025 (returns in Hungarian forints were moderated by the appreciation of the domestic currency).

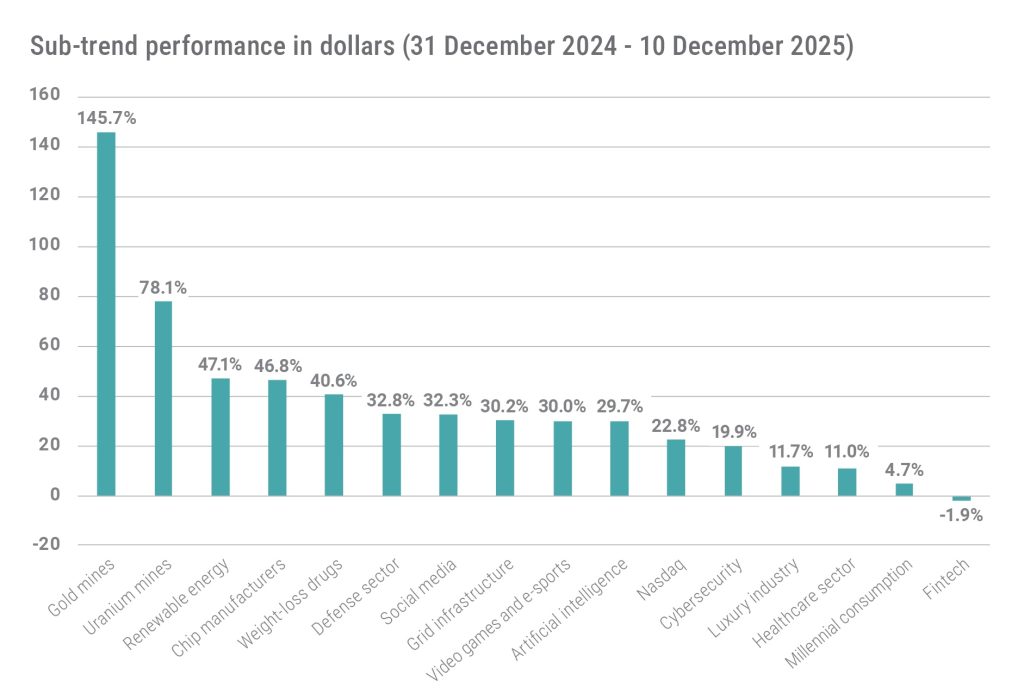

The year 2025 demonstrated significant diversification within structurally growing equity segments. Technology and innovation megatrends generated the strongest aggregate returns, followed by environmental megatrends, and finally – but not least – social and demographic megatrends. Naturally, even within individual industries, there were both winners and laggards. Let’s take a closer look.

*Data as of 15 December 2025

The star performer: Artificial Intelligence (AI)

AI has remained by far the most important driver of global equity markets, particularly in the United States. The so-called “Magnificent Seven” once again outperformed the broader market, although the degree of outperformance was less pronounced than in previous years.

Overall, profits from AI-related exposure have continued to concentrate in infrastructure segments, including semiconductor manufacturers, cloud service providers, data center operators, and hardware producers. While most investors believe that widespread AI adoption will improve economic productivity over time and generate positive effects across industries, current market focus remains primarily on those players that are likely to be short-term profit winners of the ongoing, investment-driven boom.

The wide dispersion in share price performance reflects differing levels of investor confidence regarding whether AI investments will translate into tangible revenue advantages. Differences in financial leverage used to fund these investments have also contributed to performance gaps.

The long-term contender: Cybersecurity

While bubble concerns have intensified in the “pure AI” segment, many investors view cybersecurity as a more stable, long-term growth story. As a result, the sector delivered outperformance, albeit with more moderate returns compared to AI-focused equities.

Cybersecurity is likely to be one of the biggest beneficiaries of AI-driven software applications, as AI simultaneously increases the number and complexity of threats while offering powerful tools for automation and efficiency gains in defence. The growing frequency of cyberattacks and new attack surfaces created by AI tools continue to generate structural demand for cybersecurity solutions.

The hidden weapon: The defence sector

Rising geopolitical tensions, global instability, and the megatrend of a “fragmented world” have led governments to significantly increase defence spending. Europe is undergoing a major rearmament cycle, while Japan and South Korea have also pledged substantial increases in military budgets.

The sector has been one of the primary beneficiaries of NATO’s decision to raise defence spending targets to 5% of GDP, a trend clearly reflected in this year’s returns.

Where valuations are becoming stretched: The luxury industry

The luxury sector underperformed in 2025. One key factor was the weakening purchasing power and sentiment of Chinese consumers – for years the largest buyers in the global luxury market – over the past 1–2 years.

In addition, inflationary pressures and economic slowdown, particularly in Europe, weighed on discretionary consumption. Elevated price levels have narrowed the consumer base, making luxury demand more selective and limiting volume growth. While luxury stocks delivered stable returns, growth was far from spectacular, and valuations were not always justified.

Renewed momentum in renewable energy

This year, the global clean energy equity benchmark significantly outperformed major stock indices. After two years of bear market conditions and persistent capital outflows, a fundamental shift in U.S. electricity demand outlook and improved political predictability have once again attracted investors to renewable energy stocks.

Valuations had diverged so far from fundamentals that even the confirmation of negative news acted as a positive catalyst. U.S. President Donald Trump’s “One Big Beautiful Bill,” which introduced new restrictions on energy tax credits, initially impacted the renewable energy industry negatively. However, the outcome proved far less detrimental than many had feared, providing sufficient predictability for investors to re-engage and for companies to continue their projects.

Investor sentiment toward renewable energy equities has become increasingly optimistic, as it is now evident that the energy required to power AI cannot be secured without renewables.

The underperformers: Healthcare stocks

Healthcare equities have remained underperformers, although they began to close the gap in the fourth quarter. The sector has been pressured by political concerns (pharmaceutical tariffs and pricing regulations), rising cost pressures on insurers, and the disruptive impact of weight-loss drugs on industry dynamics.

In our view, much of the negative news may already be priced in. Moreover, the sector’s long-term growth drivers remain intact: an aging population, along with technological, AI-driven, and scientific advancements, is likely to generate continued innovation.

U.S. overweight: Weight-loss drug manufacturers

Weight-loss medications undoubtedly represent a megatrend, but the investment vehicle matters greatly. Performance divergence between the two dominant players in the industry has widened dramatically this year. U.S.-based Eli Lilly soared, while Novo Nordisk nearly halved in value.

Although the GLP-1 market is currently dominated by two major players, competition intensified in 2025 and is expected to increase significantly next year. By 2026, several new entrants are preparing to launch products, including Amgen, Viking, Roche, Pfizer, and AstraZeneca, all developing injectable or oral solutions.

FinTech: Riding the AI wave

FinTech equities delivered mixed performance in 2025, reflecting both growth potential and macroeconomic challenges. Investors favored sustainable business models. While the sector has continued to develop fundamentally, driven by AI, embedded finance, and regulatory trends, equity performance varied.

SoFi delivered outstanding returns, while PayPal and Coinbase struggled. Meanwhile, Visa and Mastercard came under pressure following reports that high card fees have prompted several retailers to explore stablecoin-based payment systems that bypass traditional card networks.

Gold miners

Gold mining stocks were among the biggest winners in equity markets this year, rising by nearly 150%. Their exceptional performance was primarily driven by the explosive increase in physical gold prices, which was amplified many times over by the operating leverage inherent in mining companies.

Uranium miners: Favourable conditions

The sharp rise in uranium mining stocks in 2025 was driven not by a single factor, but by a powerful combination of reinforcing macroeconomic and industry trends. This sector emerged as one of the fastest-growing megatrends, as investors priced in structurally rising long-term demand.

A global consensus has formed that achieving climate targets requires stable, low-carbon baseload power — something renewable sources such as solar and wind, due to their intermittency, cannot provide alone. Nuclear energy has therefore become indispensable. Numerous countries have announced large-scale nuclear programs.

At the same time, tightening supply alongside rising demand has increased upward pressure on prices.

Legal Notice: The operator of this blog is VIG Asset Management Hungary and the authors are employees of the Asset Management Company. This website contains commercial communication. The articles published on the blog reflect the subjective opinions of private individuals, are prepared for informational purposes only, and do not constitute investment analysis or investment advice, nor do they contain any investment recommendations. The authors of the blog may trade in their own name in financial instruments, funds, or other products about which they provide information or express an opinion in their articles. While the authors’ experience gained in stock exchange or over-the-counter trading may be reflected in their writings on this blog, such interests must not influence the information they provide. Articles, news, and information on the blog may feature companies that maintain business relations with VIG Asset Management Hungary or with the authors of the blog, either directly or through another company belonging to the VIG Group. The articles published on this blog do not provide complete information and do not replace the assessment of the suitability of an investment, which can only be determined by evaluating the individual circumstances of the given investor. To make a well-founded investment decision, please seek detailed information from multiple sources.

VIG Asset Management Hungary, the editors, and the authors of the blog accept no responsibility for the timeliness, possible omissions, or inaccuracies of the content on the blog, nor for any investment decisions made on the basis of the blog articles, or for any direct or indirect damage or cost arising from such investment decisions.