CEE inflation outlook

Progress Made, Challenges Ahead

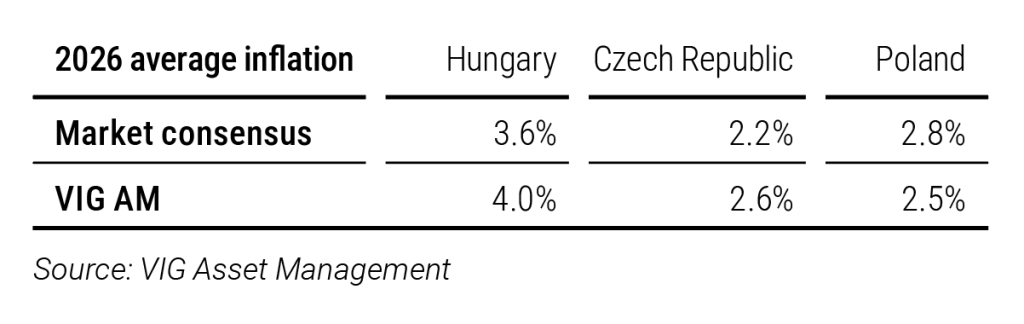

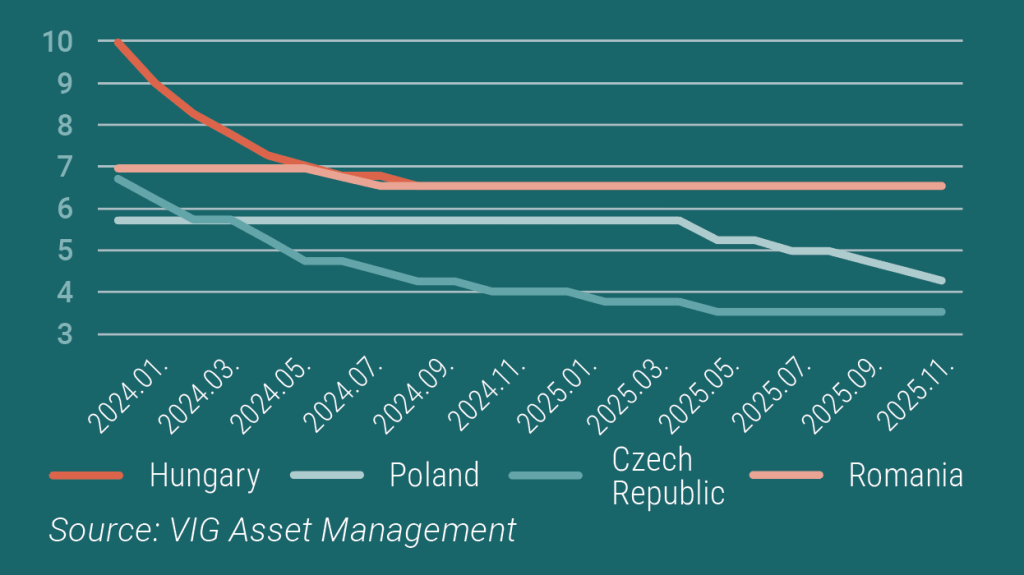

Disinflation remained the dominant theme across Hungary, Czech Republic and Poland throughout 2025. As winter set in, price pressures moderated further, and December inflation is expected to fall comfortably within central bank tolerance ranges. With this, regional easing cycles are nearing completion, while both the Czech and Hungarian central banks have already maintained a steady policy stance for some time. Although inflation targets are now within sight, 2026 is unlikely to mark full convergence for much of the region.

In the Czech Republic, the 2026 inflation outlook will be shaped primarily by the development of household energy costs, as the risks surrounding the 2025 parliamentary elections will already be behind us. Czech households face some of the highest energy costs in the EU, making cost reduction a central topic in the October election campaign. Both the government and major energy suppliers have been exploring measures to mitigate rising costs, several of which could positively influence the 2026 inflation trajectory. The central bank’s rate-cutting cycle has ended, and future moves will likely hinge on how energy costs evolve.

In Hungary, next year’s inflation dynamics will be determined primarily by the April elections and the potential extension of related government measures. Many of the policies designed to temporarily suppress inflation are scheduled to expire in 2026, meaning that the lower inflation seen in the run-up to the election will likely give way to a trend-like acceleration in the second half of the year. The magnitude of the rebound is uncertain, but artificially depressed inflation in the first half will almost certainly result in lower average inflation in 2026 than in 2025. Consequently, a renewed round of rate cuts is unlikely in the first half of the year. Service inflation is expected to remain sticky in 2026, leaving our forecast above market consensus. A stable political environment and a sustained decline in household inflation expectations will be essential prerequisites for restarting monetary easing.

In Poland, the successes achieved this year have played a major role in positioning the Polish central bank to be the first in the region to reach its inflation target in 2026. However, several risks threaten next year’s inflation path. Fiscal easing and strong domestic consumption may constrain the fight against inflation. Reducing household energy costs remains a priority in Poland as well, especially since the energy price freeze expires at the end of this year. The President nonetheless aims to reduce energy costs for both households and businesses through new decrees thereafter. Having curbed inflation more effectively than its regional peers, the Polish central bank may be approaching the end of its easing cycle.

Romania is the outlier in the region, as its inflation trajectory has diverged sharply due to government measures implemented in 2025. In summer 2025, the Romanian government introduced significant tax increases to restore fiscal balance. VAT was raised from 19% to 21%, the energy price cap was removed, and excise taxes were increased as well. As a result, Romania’s fight against inflation will lag regional peers by around one year: the high-inflation period that began in July 2025 will only end in summer 2026, after which the continuation of the rate-cutting cycle may once again become feasible.

Central bank base rates (%)

Explore moreInvestment Outlook 2026 Get the publicationDownload

This is a distribution announcement. Detailed information is needed to make a well-founded investment decision. Please inform yourself thoroughly regarding the Fund's investment policy, potential investment risks and distribution in the Fund's key investment information, official prospectus and management regulations available at the Fund's distribution outlets and on the Asset Management's website (www.vigam.hu). The costs related to the distribution of the fund (buying, holding, selling) can be found in the fund's management regulations and at the distribution outlets. Past returns do not predict future performance. Please note that in comparison with other investment funds, the return achieved may be affected by differences in the reference index and therefore the investment policy. The future performance that can be achieved by investing may be subject to tax, and the tax and duty information relating to specific financial instruments and transactions can only be accurately assessed on the basis of the individual circumstances of each investor and may change in the future. It is the responsibility of the investor to inform himself about the tax liability and to make the decision within the limits of the law. The information contained in this leaflet is for informational purposes only and does not constitute an investment recommendation, an offer or investment advice. VIG Asset Management Hungary Closed Company Limited by Shares accepts no liability for any investment decision made on the basis of this information and its consequences.

The Asset Management’s license number for managing alternative investment funds (AIFM) is: H-EN- III-6/2015. The Fund Manager’s license number for UCITS fund management (collective portfolio management) is: H-EN-III-101/2016.