USD outlook – Scenario analysis

Base case: a structurally weaker dollar (EUR/USD 1.20–1.25)

The Trump administration’s policy stance continues to lean toward a weaker dollar, with the Federal Reserve expected to cut rates multiple times—even in an environment where macro fundamentals may not fully justify such easing. Throughout much of 2025, particularly in the first half of the year, market movements closely tracked Donald Trump’s unpredictable actions and negotiation tactics. Periods of sudden USD weakness were typically linked to event risks: the announcement of reciprocal tariffs, ongoing political pressure on the Federal Reserve, demands for immediate rate cuts, the unveiling of Germany’s fiscal stimulus package, and recurring episodes in the trade war with China.

In many respects, U.S. economic policy began to resemble that of an emerging market—with all the associated risks. At times, the long-held notion of “American exceptionalism” came into question, triggering capital outflows toward other regions. As a result, the DXY dollar index fell 11% in the first half of the year—the sharpest six-month decline since 1972.

Market consensus attaches the highest probability to this scenario: an EUR/USD exchange rate rising toward 1.20–1.25 and a broadly weaker U.S. dollar. This requires further Fed rate cuts, bringing the policy rate down to around 3,5%, or potentially below. Such an outcome could be driven not only by a notable softening in the U.S. labor market, but also by a scenario in which growth remains more resilient than expected while the administration—supported by a newly appointed Fed Chair—exerts political pressure to cut rates more than justifiable.

Fundamental pressures from a widening fiscal deficit and deteriorating debt metrics, or a slowdown triggered by an AI bubble bursting, could similarly weigh on the dollar—though these begin to overlap with the alternative scenarios discussed later.

Under the classical “dollar smile” framework, stronger relative growth outside the U.S. would also support USD weakness. In the euro area, gradually accelerating fiscal stimulus may help cyclical momentum, while in emerging markets a weaker dollar could reinforce a virtuous cycle of lower risk premia, declining policy rates and stronger currencies.

Event-risk catalysts remain heavily tied to Trump. It is difficult to envision a year without new tariff announcements or unexpected twists in the temporary U.S.–China truce. Persistent political pressure on the Federal Reserve is also likely – which we already discussed above.

Unexpected political maneuvers ahead of the 2026 U.S. midterm elections could also lift risk premia. Paradoxically, the absence of such surprises is the biggest risk to the weaker-dollar scenario.

We nonetheless view the weak dollar environment as the base case because reducing the U.S. trade deficit and improving industrial competitiveness remain core strategic priorities of the Trump administration. Higher tariffs, a weaker dollar and lower interest rates are seen as essential tools. Trump’s favored economist—Stephen Miran, now a Fed policymaker—has repeatedly argued that America’s trade deficit is not due to fiscal policy, but rather to an overvalued dollar. With many of his policy proposals already implemented, the strategic preference for a weaker dollar is unlikely to disappear.

But for the dollar to weaken more meaningfully than consensus the market would probably need a new narrative, like

- deeper-than-expected rate cuts,

- Plaza-Accord-style FX intervention, or

- even U.S. yield-curve control (YCC) aimed at suppressing long-term yields.

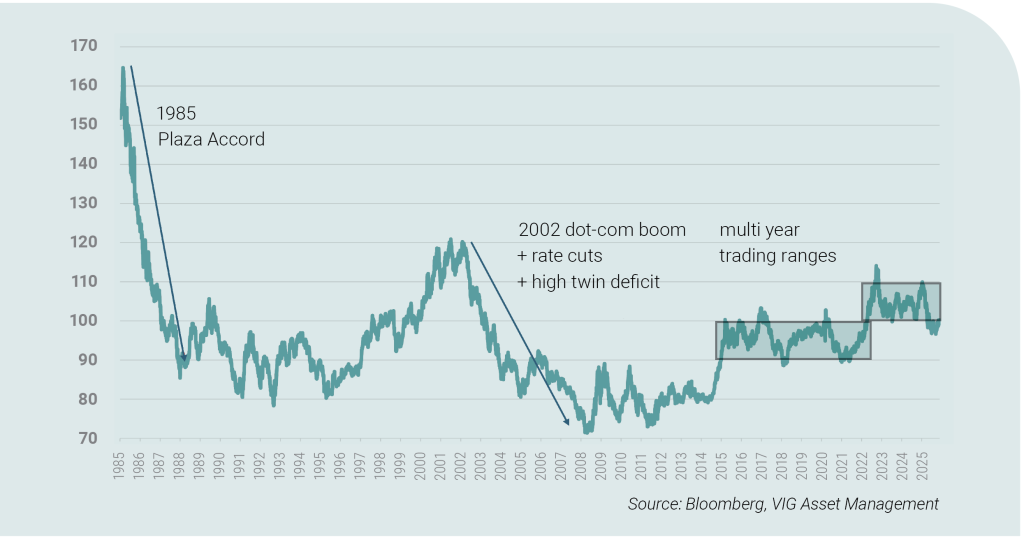

If further actions follow in 2026, historical precedents suggest meaningful downside remains: the dollar fell ~25% between 1974–78, over 50% between 1985–87, and more than 40% between 2002–08.

Medium-Probability Scenario:

No Unorthodox Measures, Resilient U.S. Growth(EUR/USD falls to 1.10)

Without further surprises from U.S. policymakers, the dollar could stabilize, find a bottom, or even begin to strengthen. The tariff conflict appears to have calmed, and markets have reacted less intensely to trade-related headlines. With the U.S. achieving tariff outcomes favorable to its interests, policy uncertainty may diminish—an inherently USD-supportive development.

“American exceptionalism” also returned after the temporary wobble in April, and interest-rate differentials could shift back in favor of the dollar. Looking ahead to the 2026 midterm elections, Trump will likely prioritize a strong economy, reducing the incentives for political shocks or renewed trade escalation.

Stronger-than-expected U.S. growth, driven by an extended AI-driven productivity boom, would clearly support the dollar.

Alternative Scenario:

Debt Crisis, Surging Long-Term Yields or an AI Bubble Burst – Fed Cuts Deep Below 3%, USD Collapses (EUR/USD above 1.30)

“Expect the unexpected.” While implied recession probabilities remain low, multiple vulnerabilities threaten U.S. financial stability: extreme market concentration, stretched valuations, AI-driven exuberance and the growing dependence of U.S. households on equity-market performance. It remains uncertain whether massive AI-related capex will ever deliver the expected returns.

Globally, structurally rising debt levels and persistent fiscal deficits are increasingly unsustainable. A bond-market revolt could push long-term yields sharply higher—often a precursor to recession.

In such an environment, the Fed faces a dilemma: if soaring long-term yields trigger market stress, cutting short-term rates alone may worsen instability. Yet historically, the Fed reacts faster and more forcefully than any other central bank—a dynamic that may intensify under a new Fed leadership. In a recession, the USD typically weakens sharply, which would likely occur again.

However, in the early phase of a shock, EM currencies would suffer as risk premia spike and carry trades unwind—limiting their initial benefit from a weaker USD.

A true “wild card” scenario emerges if Trump or the Fed acts unexpectedly: a renewed tariff war with China, or more dramatically, the introduction of yield-curve control to cap long-term U.S. yields (for example at 3.5%). Such measures could trigger a severe dollar crisis, pushing EUR/USD above 1.30.

Summary

Our base case remains an EUR/USD rise above 1.20. However, for the dollar to weaken further, the Trump administration will need to introduce new policy actions—existing narratives are losing momentum. We maintain a structurally bearish USD view because weakening the dollar aligns with key strategic goals of the administration and its leading economists. But delivering this outcome in 2026 will probably require renewed action.

DXY dollar index in the past 40 years

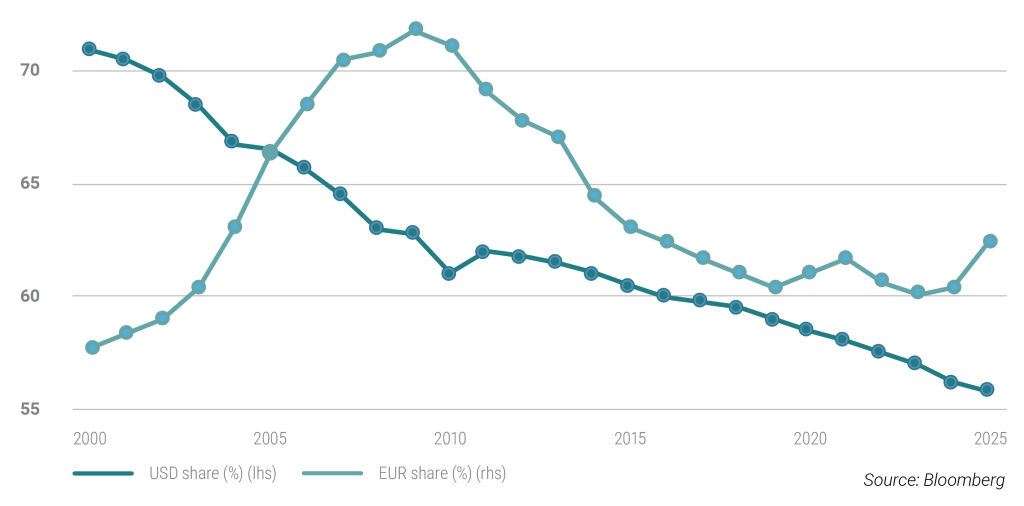

USD share of reserves fell, EUR share rose in Q2 2025

Current composition of global foreign exchange reserves

Explore moreInvestment Outlook 2026 Get the publicationDownload

This is a distribution announcement. Detailed information is needed to make a well-founded investment decision. Please inform yourself thoroughly regarding the Fund's investment policy, potential investment risks and distribution in the Fund's key investment information, official prospectus and management regulations available at the Fund's distribution outlets and on the Asset Management's website (www.vigam.hu). The costs related to the distribution of the fund (buying, holding, selling) can be found in the fund's management regulations and at the distribution outlets. Past returns do not predict future performance. Please note that in comparison with other investment funds, the return achieved may be affected by differences in the reference index and therefore the investment policy. The future performance that can be achieved by investing may be subject to tax, and the tax and duty information relating to specific financial instruments and transactions can only be accurately assessed on the basis of the individual circumstances of each investor and may change in the future. It is the responsibility of the investor to inform himself about the tax liability and to make the decision within the limits of the law. The information contained in this leaflet is for informational purposes only and does not constitute an investment recommendation, an offer or investment advice. VIG Asset Management Hungary Closed Company Limited by Shares accepts no liability for any investment decision made on the basis of this information and its consequences.

The Asset Management’s license number for managing alternative investment funds (AIFM) is: H-EN- III-6/2015. The Fund Manager’s license number for UCITS fund management (collective portfolio management) is: H-EN-III-101/2016.