Successful monthly tactical asset allocation in 2025

Global markets in 2025 were shaped by investor expectations surrounding the inauguration of the new U.S. president, the uncertainty triggered by an emerging trade war, and the subsequent wave of optimism that drove equities to new record highs.

The gradual weakening of the U.S. dollar and a strong rally in gold further supported market sentiment. AI-driven innovation once again propelled the U.S. technology sector to the forefront, with the “Magnificent 7” companies—Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla—delivering particularly strong performance. Although the announcement of new US tarrifs in April caused a brief but sharp correction, markets stabilised quickly and risk appetite strengthened again in the second half of the year. Emerging markets—led by the CEE region—outperformed, supported by attractive valuations, improving earnings expectations and a more stable macroeconomic backdrop.

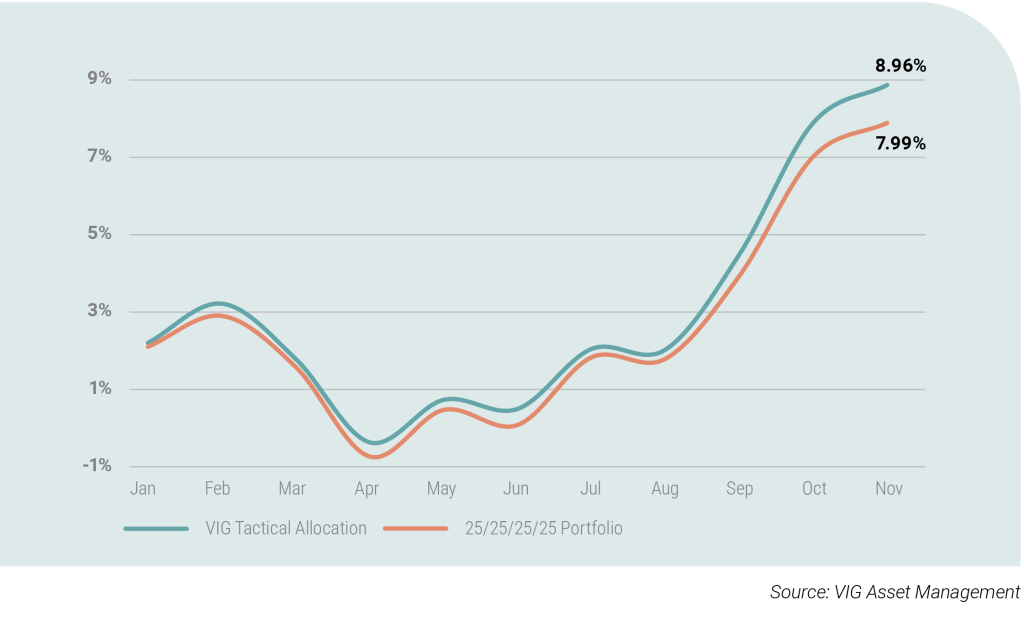

Following strong results in 2023 and 2024, VIG AM’s monthly tactical asset allocation continued to adapt effectively to rapidly changing market conditions in 2025. Supported by our Investment Clock framework and the asset-class-specific Quadrant analysis, our monthly investment process resulted in a model portfolio that outperformed its benchmark by 87 basis points in EUR terms by the end of November 2025 (benchmark allocation: 25% money market, 25% bonds, 25% commodities, 25% equities), clearly reflecting the success of our monthly tactical decisions.

The 8.96% nominal EUR return and the strong relative performance were driven primarily by commodity and equity allocation decisions. The underweight in commodities, combined with the timely downgrade and subsequent upgrade of gold—particularly during the autumn price rally—provided a meaningful contribution to returns. Within equities, the overweight in CEE markets—2025’s best-performing equity region—and the underweight in European equities, which performed well early in the year, but lagged thereafter, were key performance drivers. The persistent strength of U.S. equities and our summer underweight position had only a limited negative impact on overall returns, as the weaker dollar helped cushion the effect.

Explore moreInvestment Outlook 2026 Get the publicationDownload

This is a distribution announcement. Detailed information is needed to make a well-founded investment decision. Please inform yourself thoroughly regarding the Fund's investment policy, potential investment risks and distribution in the Fund's key investment information, official prospectus and management regulations available at the Fund's distribution outlets and on the Asset Management's website (www.vigam.hu). The costs related to the distribution of the fund (buying, holding, selling) can be found in the fund's management regulations and at the distribution outlets. Past returns do not predict future performance. Please note that in comparison with other investment funds, the return achieved may be affected by differences in the reference index and therefore the investment policy. The future performance that can be achieved by investing may be subject to tax, and the tax and duty information relating to specific financial instruments and transactions can only be accurately assessed on the basis of the individual circumstances of each investor and may change in the future. It is the responsibility of the investor to inform himself about the tax liability and to make the decision within the limits of the law. The information contained in this leaflet is for informational purposes only and does not constitute an investment recommendation, an offer or investment advice. VIG Asset Management Hungary Closed Company Limited by Shares accepts no liability for any investment decision made on the basis of this information and its consequences.

The Asset Management’s license number for managing alternative investment funds (AIFM) is: H-EN- III-6/2015. The Fund Manager’s license number for UCITS fund management (collective portfolio management) is: H-EN-III-101/2016.