AI is also affecting “green stocks”

Solar plus storage is emerging as the only solution that can be scaled up in the short term.

This year, the global benchmark for clean energy stocks has far outperformed the major stock indices and generated nearly as much return as gold. The S&P Global Clean Energy index, which tracks the average price change of a wide range of global renewable energy companies, has achieved a return of approximately 51.5% in US dollars since the beginning of the year through mid-November.

What is behind the rise?

After two years of a bear market and continuous capital outflows, a fundamental change in the outlook for U.S. electricity demand and the greater political predictability are once again attracting investors. Valuations have become so detached from fundamentals that even confirmation of negative news has become a positive catalyst. U.S. President Donald Trump’s “One Big Beautiful Bill” package (which introduces new restrictions on energy tax credits) has had a significant impact on the renewable energy industry. However, the outcome was far less negative than many had feared and provides enough predictability for investors to recommit and companies to continue their projects.

Investors are increasingly optimistic about renewable energy stocks as it becomes increasingly clear that the energy required to power artificial intelligence cannot be provided without renewables. So, the current rally is also being driven by growing electricity demand, generated by rapid investment in AI data centers by large technology companies, the electrification of transportation and industry, and the development of network infrastructure (to enable the latter to handle the increased load). Electricity consumption in the United States, which has stagnated for more than a decade, is now poised for steep growth. With a shortage of gas turbines and nuclear projects still years away, solar plus storage is emerging as the only scalable solution in the short term.

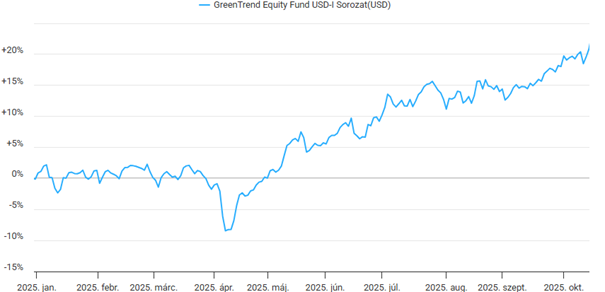

For investors seeking to benefit from this trend, the VIG GreenTrend Equity Investment Fund may offer an attractive opportunity, as a significant portion of its portfolio consists of shares in the renewable energy sector. The primary goal of the fund is sustainable investment: it aims to generate profits while also having a positive impact on environmental and social processes.

Source: VIG Asset Management

These trends show that the renewable energy sector is shifting from a subsidy-driven model to a market that is primarily shaped by demand, where strong demand requires the involvement of all energy sources. This is starting to give companies real momentum for growth, especially those involved in AI, data centers, or networking. Artificial intelligence-driven energy demand could double by 2028, favouring rapidly deployable solar, energy storage, and gas capacities.

However, even so, the rise in S&P’s clean energy index is still only half of what it was in 2021, when green investments were at their peak and interest rates were at historic lows. Now, however, the Federal Reserve’s more dovish tone is also benefiting the market. Investors are increasingly pricing in a cautious easing cycle after interest rates peak. Lower borrowing costs are an advantage for capital-intensive renewable energy projects, although interest rates are still well above the extremely low levels seen during the heyday of sustainability investments.

Why does the market continue to view renewables as a structural megatrend?

Those who have invested in renewable energy stocks over the past 5-6 years have experienced the phases of the so-called “Gartner hype cycle” curve, which illustrates the maturity, adaptation, and social application of individual technologies. However, after the “green bubble” of 2020-21 and the interest rate shock of 2022-23, the sector’s stocks have recovered significantly by 2025, and the outlook remains positive. This year, wind and solar energy together exceeded coal’s share of global electricity generation for the first time, marking a structural turning point in the energy mix. According to the International Energy Agency’s (IEA) main scenario, between 2023 and 2030, renewable energy consumption will increase by nearly 60%, with the share of renewables in final energy consumption rising from 13% to almost 20%, and in electricity generation from 30% to 46%. The EMSZ’s goal of tripling capacity by 2023, as committed to at the COP28 climate change conference, implicitly sets a “floor” for renewable investments: if the pace slows, even greater efforts (and support intensity) will be needed in the coming years.

The sector’s prospects naturally depend on interest rate trends and political decisions, but the need to transform the energy system means that the investment cycle is likely to remain strong. In the long term, renewables clearly represent a structural megatrend, supported by record investments, lasting cost advantages, climate targets and regulatory support, as well as the turning points already visible in global electricity generation (wind+solar > coal).

Legal Notice: The operator of this blog is VIG Asset Management Hungary and the authors are employees of the Asset Management Company. This website contains commercial communication. The articles published on the blog reflect the subjective opinions of private individuals, are prepared for informational purposes only, and do not constitute investment analysis or investment advice, nor do they contain any investment recommendations. The authors of the blog may trade in their own name in financial instruments, funds, or other products about which they provide information or express an opinion in their articles. While the authors’ experience gained in stock exchange or over-the-counter trading may be reflected in their writings on this blog, such interests must not influence the information they provide. Articles, news, and information on the blog may feature companies that maintain business relations with VIG Asset Management Hungary or with the authors of the blog, either directly or through another company belonging to the VIG Group. The articles published on this blog do not provide complete information and do not replace the assessment of the suitability of an investment, which can only be determined by evaluating the individual circumstances of the given investor. To make a well-founded investment decision, please seek detailed information from multiple sources.

VIG Asset Management Hungary, the editors, and the authors of the blog accept no responsibility for the timeliness, possible omissions, or inaccuracies of the content on the blog, nor for any investment decisions made on the basis of the blog articles, or for any direct or indirect damage or cost arising from such investment decisions.