More, more, more – and still not enough

That seems to be the motto of the world’s largest tech companies, as they continue to pour unprecedented sums into artificial intelligence. Investors, however, are drawing a line: patience is limited, and the clock is ticking for those who fail to deliver tangible returns.

Last week, companies representing 44% of the S&P 500’s market capitalization released their earnings – including all the major technology giants. The spectacle didn’t disappoint: data center investments are not only maintaining their pace but are expected to accelerate through 2026, powered by immense structural demand. This is no passing trend – the AI investment boom is the driving engine of today’s bull market.

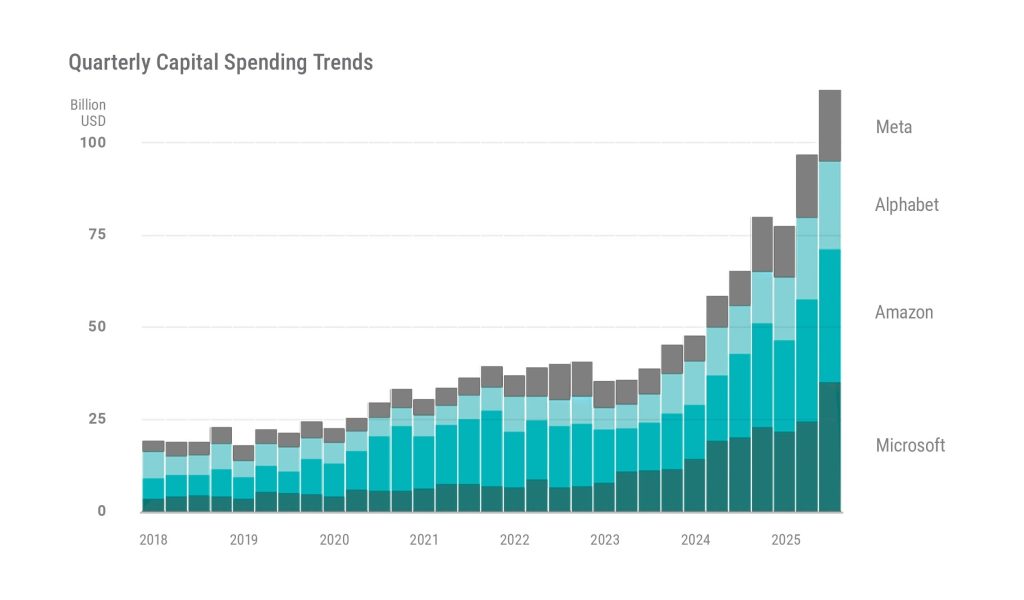

The U.S. tech titans – Meta Platforms, Microsoft, Amazon.com, and Alphabet (Google) – plan to invest a combined total of over $400 billion in AI infrastructure this year alone (covering data centers, chips, and cloud services). And even that, according to their executives, won’t be enough.

Meta continues to struggle with capacity shortages as it simultaneously trains new AI models and runs existing products. Microsoft faces overwhelming customer demand for its cloud services and aims to double its data center capacity within two years. Amazon is also racing against time to deploy new cloud infrastructure as quickly as possible.

AI is no longer the future – it is the business of today. (Investors who believe in this trend might explore the VIG InnovationTrend ESG Equity Fund, where artificial intelligence is one of the central themes and major tech names are among the fund’s top holdings.)

Source: WSJ, https://www.wsj.com/tech/ai/big-tech-is-spending-more-than-ever-on-ai-and-its-still-not-enough-f2398cfe?mod=Searchresults&pos=1&page=1

Source: WSJ, https://www.wsj.com/tech/ai/big-tech-is-spending-more-than-ever-on-ai-and-its-still-not-enough-f2398cfe?mod=Searchresults&pos=1&page=1

NVIDIA: The Engine of the AI Revolution

NVIDIA did not release a financial report, but instead made headlines at a developer conference with a wave of groundbreaking AI announcements. The company unveiled new strategic partnerships, massive projects, and forward-looking initiatives. It is acquiring nearly a 3% stake in Nokia for $1 billion, collaborating on the development of 6G mobile network technology.

In partnership with the U.S. Department of Energy, NVIDIA is building seven AI supercomputers, including systems designed to support nuclear research and quantum development. Starting in 2027, it will equip 100,000 autonomous vehicles with NVIDIA chips in collaboration with Uber.

Further initiatives include healthcare robotics development with Johnson & Johnson, an AI supercomputer for pharmaceutical research with Eli Lilly, and new partnerships with Palantir and CrowdStrike. The company also announced a backlog of AI chip orders worth $500 billion—more than double its projected revenue for this year.

NVIDIA is no longer positioning itself as “just” a chip manufacturer; it aims to become a cornerstone of the AI era, with its technology playing a role in every major technological revolution.

Microsoft: Investing Heavily in Cloud and AI Growth

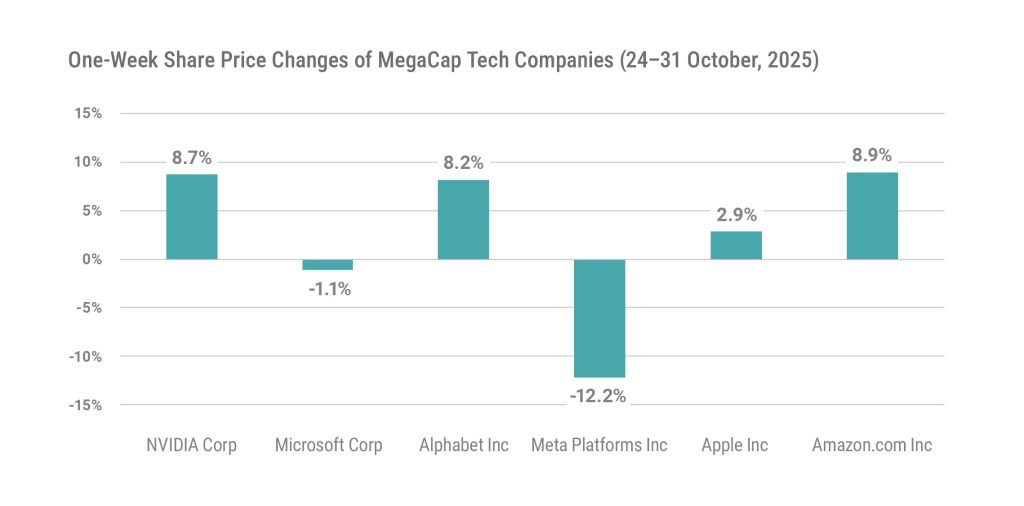

Microsoft once again beat expectations – yet its stock slipped. The reason: record capital expenditures. Revenue hit $77.7 billion (+18%), driven by Azure’s 39% growth, one of the fastest in the market. CapEx soared to $34.9 billion, up from $24 billion last quarter. CEO Satya Nadella said demand is so strong that Microsoft will double its data center footprint within two years and increase AI capacity by 80% this year. The company remains one of the biggest winners of the AI boom — but investors now expect to see concrete returns.

Alphabet (Google): AI-Fueled Acceleration

Alphabet exceeded all expectations: revenue reached $102.3 billion (+16%), and EPS was $2.87 (vs. $2.26 expected). Google Cloud grew 34% year-over-year, while capital spending climbed to $91–93 billion. The company’s Gemini model now reaches 650 million monthly users, closing in on ChatGPT’s global lead. Alphabet has proven it can monetize AI, and investors rewarded it with an 8% stock price jump.

Meta: Betting Big on AI, but Uncertainty Remains

Meta (Facebook, Instagram, WhatsApp) reported strong growth but rising costs. Revenue came in at $51.2 billion (+26%), but profits were hit by a one-off tax item. Annual investments are expected to reach $70–72 billion, possibly $100 billion next year. CEO Mark Zuckerberg spoke about building “superintelligence” — AI that could surpass human capabilities.Investors remain cautious, questioning whether such massive spending will pay off. Still, AI-driven algorithms already boost engagement: Facebook usage is up 5%, Instagram 30% — good news for advertisers.

Apple: A Quiet Quarter with Promising Outlook

Apple delivered solid but modest growth: Revenue $102.5 billion (+8%), EPS $1.85 (vs. $1.77 expected). Services revenue hit $28.8 billion (+15%), the fastest-growing segment. China was weak, but CEO Tim Cook cited supply issues, not waning demand. While Apple remains behind in AI innovation, its services growth and strong cash generation provide a solid foundation — though investors question whether it justifies current valuations.

Amazon: Back on a Strong Growth Track

Amazon surprised even optimists with an exceptionally strong quarter: Revenue $180 billion (+12%), profit $21 billion (+40%), AWS growth +20%, and ad revenue up 22%. CEO Andy Jassy announced plans to invest $125 billion next year, doubling data center capacity and advancing AI-powered logistics and automation. Amazon has reclaimed its leadership position in both the cloud and AI race.

Source: VIG AM, Bloomberg

The recent stock price movements clearly reflect the mixed reactions among investors, stemming from uncertainty about whether these massive expenditures will ultimately pay off. The market’s response to the earnings of the major technology giants this week indicates that investors are willing to tolerate surging capital expenditures only when they are backed by strong earnings growth and credible prospects for monetizing AI investments in the future.

Investors Split on the AI Spending Frenzy

Stock movements reveal mixed reactions. The market is now clearly distinguishing between AI investments backed by real revenue growth and those driven mainly by ambition.

Investors are divided into two camps:

- The believers argue that these massive investments are essential to reach Artificial General Intelligence (AGI) – the level where AI surpasses human intellect. Whoever gets there first will enjoy an unassailable competitive advantage.

- The skeptics question whether multi-billion-dollar large language models (LLMs) will ever deliver on that promise, noting that paid user adoption remains limited and widespread productivity gains are still years away.

One thing is certain: the AI race is far from over – and the stakes have never been higher.

Legal Notice: The operator of this blog is VIG Asset Management Hungary and the authors are employees of the Asset Management Company. This website contains commercial communication. The articles published on the blog reflect the subjective opinions of private individuals, are prepared for informational purposes only, and do not constitute investment analysis or investment advice, nor do they contain any investment recommendations. The authors of the blog may trade in their own name in financial instruments, funds, or other products about which they provide information or express an opinion in their articles. While the authors’ experience gained in stock exchange or over-the-counter trading may be reflected in their writings on this blog, such interests must not influence the information they provide. Articles, news, and information on the blog may feature companies that maintain business relations with VIG Asset Management Hungary or with the authors of the blog, either directly or through another company belonging to the VIG Group. The articles published on this blog do not provide complete information and do not replace the assessment of the suitability of an investment, which can only be determined by evaluating the individual circumstances of the given investor. To make a well-founded investment decision, please seek detailed information from multiple sources.

VIG Asset Management Hungary, the editors, and the authors of the blog accept no responsibility for the timeliness, possible omissions, or inaccuracies of the content on the blog, nor for any investment decisions made on the basis of the blog articles, or for any direct or indirect damage or cost arising from such investment decisions.