On your mark, get set, weapon?

Increased military spending in the European Union due to the Russo-Ukrainian war starting in 2022 would change the position of Article 8 (light green) and Article 9 (dark green) funds. The growing geopolitical tensions have prompted the European Commission to launch the ReArm Europe/Readiness 2030 initiative, which aims to strengthen the EU’s military and defense capabilities. By 2030, €800 billion of funding is expected to flow into the sector to accelerate adaptation to the current situation, which may raise concerns about the compatibility of ESG (E – environmental, S – social, G – governance) policies.

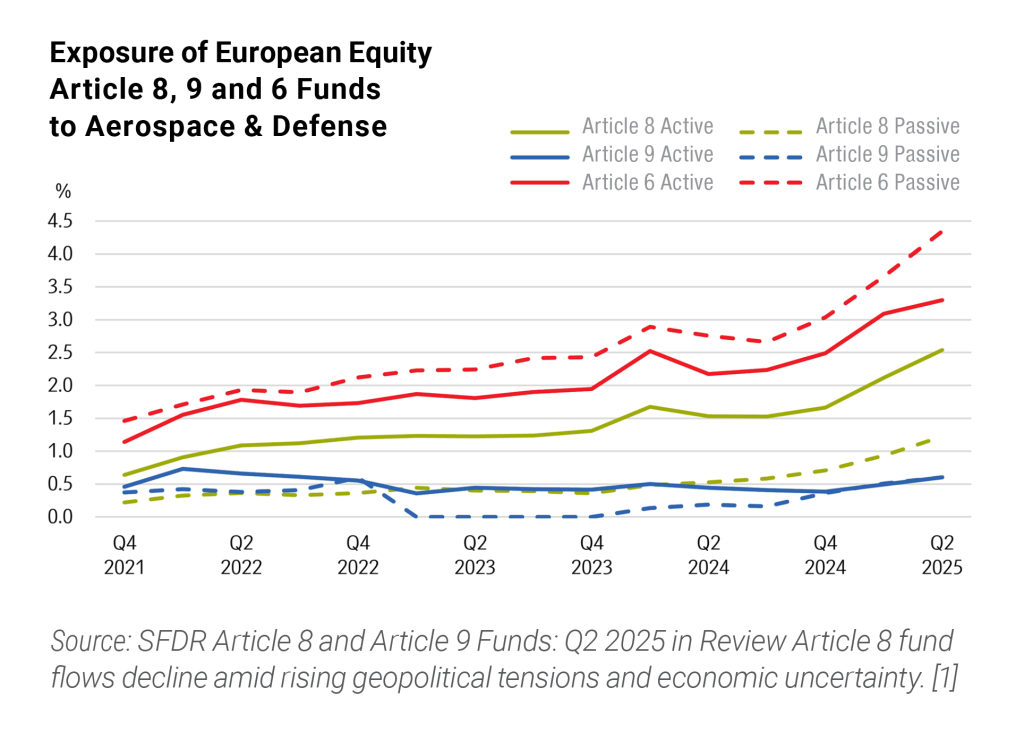

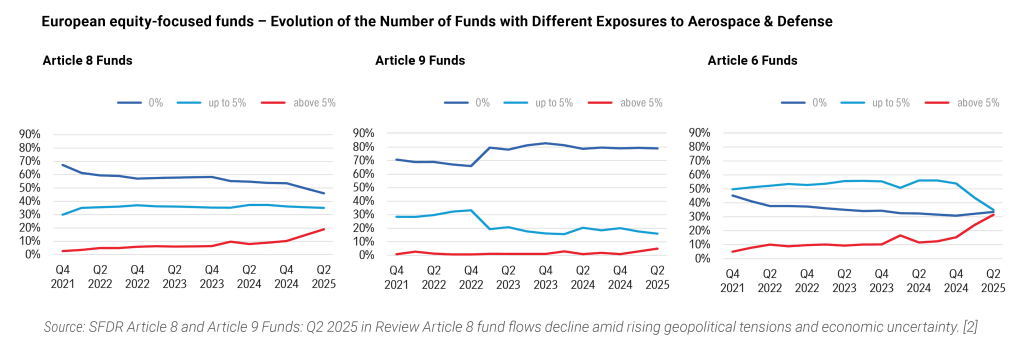

Since the start of the war, inv estors’ general interest in the aerospace and defense industry has been growing, as reflected in the increased exposure to stocks in this sector in Article 6 and 8 funds. However, this trend is not observed in dark green funds.

Over the past three and a half years, both actively and passively managed Article 6 and 8 equity funds have seen a sharp increase in their exposure to the aerospace and defense industry.

Compared to Article 6 funds, Article 8 funds’ exposure to the aerospace and defense industry remains relatively low due to strict exclusion criteria, while Article 9 funds have almost zero exposure to companies active in this industry.

Two main factors may explain the increase in exposure: on the one hand, the increased long positions by fund managers, and on the other hand, the appreciation of defense stocks.

The graphs above show how the exposure of European equity funds has changed over time according to their SFDR classification.

Since 2022, the share of Article 6 and Article 8 funds that state in their prospectus that they exclude controversial weapons from their investments has increased from 19% to 29% at Article 6 funds and from 76% to 92% at Article 8 funds.

As there is no single regulatory definition of the term “controversial weapons”, the types of companies subject to exclusion may vary: some funds exclude only companies that produce controversial weapons, while others also exclude companies that provide components, logistics or support services. In addition, some funds exclude all nuclear weapons-related activities, while others make exceptions for companies based in countries that have signed the Treaty on the Non-Proliferation of Nuclear Weapons (NPT).

This does not mean that the regulatory framework is changing, but there are factors that definitely demonstrate the changing environment of Article 8 and Article 9 funds and are worth monitoring in the future.

We are also closely following the changing environment at VIG Asset Management Hungary, so we reserve the right to change the aerospace and defense exposure of our investment funds in any direction, taking into account the effective external and internal regulations, in order to ensure that our clients benefit from market developments to the greatest extent possible.

The article was based on the analysis of ’SFDR Article 8 and Article 9 Funds: Q2 2025 in Review Article 8 fund flows decline amid rising geopolitical tensions and economic uncertainty’.

[1]-[2]: Bioy, Hortense, et al. SFDR Article 8 and Article 9 Funds: Q2 2025 in Review Article 8 Fund Flows Decline amid Rising Geopolitical Tensions and Economic Uncertainty. Morningstar Sustainalytics , 29 July 2025. Available at: https://assets.contentstack.io/v3/assets/blt9415ea4cc4157833/bltdb931b89f7bc073c/SFDR_Article_8_and_Article_9_Funds_Q2_2025.pdf?utm_source=eloqua&utm_medium=email&utm_campaign=&utm_content=_32731&utm_id= [Accessed 3rd September, 2025]

Legal Notice: The operator of this blog is VIG Asset Management Hungary and the authors are employees of the Asset Management Company. This website contains commercial communication. The articles published on the blog reflect the subjective opinions of private individuals, are prepared for informational purposes only, and do not constitute investment analysis or investment advice, nor do they contain any investment recommendations. The authors of the blog may trade in their own name in financial instruments, funds, or other products about which they provide information or express an opinion in their articles. While the authors’ experience gained in stock exchange or over-the-counter trading may be reflected in their writings on this blog, such interests must not influence the information they provide. Articles, news, and information on the blog may feature companies that maintain business relations with VIG Asset Management Hungary or with the authors of the blog, either directly or through another company belonging to the VIG Group. The articles published on this blog do not provide complete information and do not replace the assessment of the suitability of an investment, which can only be determined by evaluating the individual circumstances of the given investor. To make a well-founded investment decision, please seek detailed information from multiple sources.

VIG Asset Management Hungary, the editors, and the authors of the blog accept no responsibility for the timeliness, possible omissions, or inaccuracies of the content on the blog, nor for any investment decisions made on the basis of the blog articles, or for any direct or indirect damage or cost arising from such investment decisions.