Romania is facing a political and economic turning point that could have a significant impact on regional investments — and Hungarian investors, in particular, should keep a close eye on developments across the border. At the same time, this environment could also present a compelling investment opportunity.

Political Uncertainty – Who Will Be the Next President?

Following the first round of Romania’s presidential elections, the country’s political future remains uncertain. After the surprise annulment of last year’s initial election results, financial markets were temporarily relieved by the disqualification of the openly anti-EU, pro-Moscow candidate Georgescu. However, the second attempt in May has seen a surge in anti-establishment sentiment. George Simion, leader of the nationalist AUR party, who received relatively few votes in the initial round, won the first round this time with a considerably stronger showing — outperforming Georgescu’s earlier result — and is now seen as a serious contender. His potential victory would mark a political shift and introduce further economic uncertainty, given his party’s highly populist stance.

Of the four likely scenarios ahead of the elections, three were seen as relatively market-friendly and one as negative. Now, with two of the favourable options off the table, we’re left with a binary outcome — one good, one bad. Betting markets currently assign roughly a 70% probability to Simion’s victory. Meanwhile, a government crisis has also erupted: Prime Minister Ciolacu has resigned, and the ruling PSD party has declared it will not endorse any candidate in the runoff, weakening the chances of independent Bucharest mayor Nicușor Dan.

Why Does the Presidential Outcome Matter?

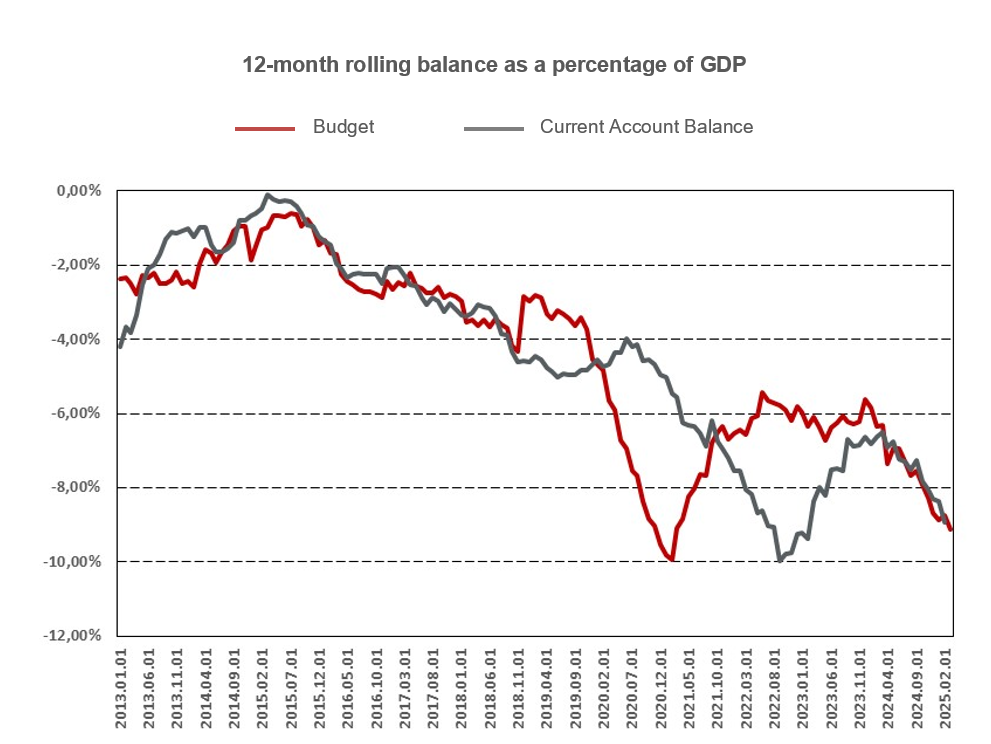

The core issue lies in Romania’s fiscal fundamentals. The country has long followed an aggressively expansionary fiscal policy — essentially spending far beyond its means. In 2024, Romania posted a budget deficit of 9.3% of GDP (compared to the European Commission’s forecast of 7.9%). Since the pandemic, the deficit has never fallen below 6.4%. Meanwhile, the current account deficit has remained between 7–9% for years, creating a classic twin deficit scenario.

Debt sustainability is becoming a serious concern. Romania’s public debt has risen from around 10% of GDP to over 50% in less than two decades. Some pessimistic forecasts suggest this could rise to 70–90% before the end of the decade if current trends continue. To make matters worse, Q1 2025 data shows another sharp deterioration in the deficit. Without immediate adjustments, the 2025 deficit could reach or exceed 9% again.

This is problematic for two key reasons. First, Romania has committed to reducing its deficit to 7% in 2025 and 6.4% in 2026 — so we are already seeing a 2–3% slippage. The European Commission is set to release updated projections on May 16. Given the deviation, there’s growing risk that, alongside an Excessive Deficit Procedure (EDP), the EU could partially suspend funding around June 4, unless Romania enacts meaningful fiscal consolidation. Second — and potentially more serious — is the risk posed by credit rating agencies. Romania has been teetering at the lowest investment-grade rating for years, and a downgrade would push it into junk status, with all the consequences that entails. Both the EU and the rating agencies are expected to hold off decisions until late May — meaning the new government may only have two weeks after the runoff to introduce significant austerity measures.

Yet Romania currently lacks a well functioning government. The prime minister has resigned, an interim interior minister has taken over, and the incoming president could appoint a new prime minister or influence the government formation. Romania has seen prolonged government formation crises before — and any such delay now would postpone the much-needed fiscal adjustments. Time is running out. It doesn’t help that Simion, who leads the polls, has made little mention of fiscal consolidation and has openly stated he would include the previously disqualified Georgescu in his future cabinet — potentially as prime minister.

Source: Bloomberg

A Weakening Leu and Rising Price Pressures

Following the election results, the Romanian leu (RON) fell sharply against the euro, dropping to 5.095 — a 2.5% depreciation, driven by political turmoil. This is notable because the RON is heavily managed by Romania’s central bank. Since 2022, it has weakened by about 1% annually on average, compared to 2% in earlier years.

Analyst consensus suggests the RON is overvalued by at least 5%, with some estimates pointing to as much as 30%. Still, this presents a dilemma: a devaluation is inevitable in the current context, but it must be gradual. Romania is a highly euroized economy, meaning exchange rate pass-through to inflation is high. A sharp devaluation would immediately fuel inflation and hurt household confidence and spending.

While the central bank (NBR) is attempting to defend the currency, the RON is expected to continue weakening gradually over the longer term — driven by the persistent budget and external deficits.

Why Should Hungarian Investors Care?

Romania is one of Hungary’s significant economic partners, and movements in the Romanian market can indirectly affect Hungarian assets — particularly through regional investment funds. Recently, Hungarian government bond yields came within 15–20 basis points of Romanian levels (10–15 year yields peaked at ~7.25% in Hungary, vs. ~7.5% in Romania). Now the spread has widened again: long-dated Hungarian yields have dropped below 7%, while Romanian yields have surged to 8–8.2%.

This makes Romanian bonds look more attractive. For example, a 10-year euro-denominated Romanian bond offers a 7% yield, compared to 5.3% for Serbian and under 5% for Hungarian equivalents. In fact, Romanian government bonds already seem to have priced in a potential downgrade — they are trading at junk-like spreads. Of course, if the country is downgraded, certain investors will be forced to sell regardless of pricing, which could push yields even higher.

Summary: A Fragile Outlook, but a Potential Opportunity

Romania’s fiscal fundamentals are on shaky ground, and political uncertainty is compounding the problem. Time is of the essence: Romania must urgently announce credible fiscal consolidation measures. This will require politically sensitive steps such as raising VAT or income tax, or cutting back on public investment — all highly unpopular moves.

The key question is: who will take the political risk to implement them?

In our view, such measures are inevitable, as market pressure will eventually force action. Timing, however, remains uncertain. This presents both risk and opportunity. From an investment standpoint, we are monitoring developments closely in our funds. The current situation could lead to a compelling entry point — perhaps after one more wave of market panic.

A victory for Nicușor Dan in the runoff or a credible fiscal package announced before the end of May could spark a strong rally in Romanian government bonds. Conversely, a Simion victory, prolonged government crisis, and potential involvement of Georgescu could delay resolution, trigger another selloff, and possibly a downgrade. Investors should keep a close eye on Romania — both in a regional context and in search of opportunity.