What happened in the last month?

In focus: one Hundredfold Growth Since Launch: The BUX Index Outpaces the Hungarian Economy

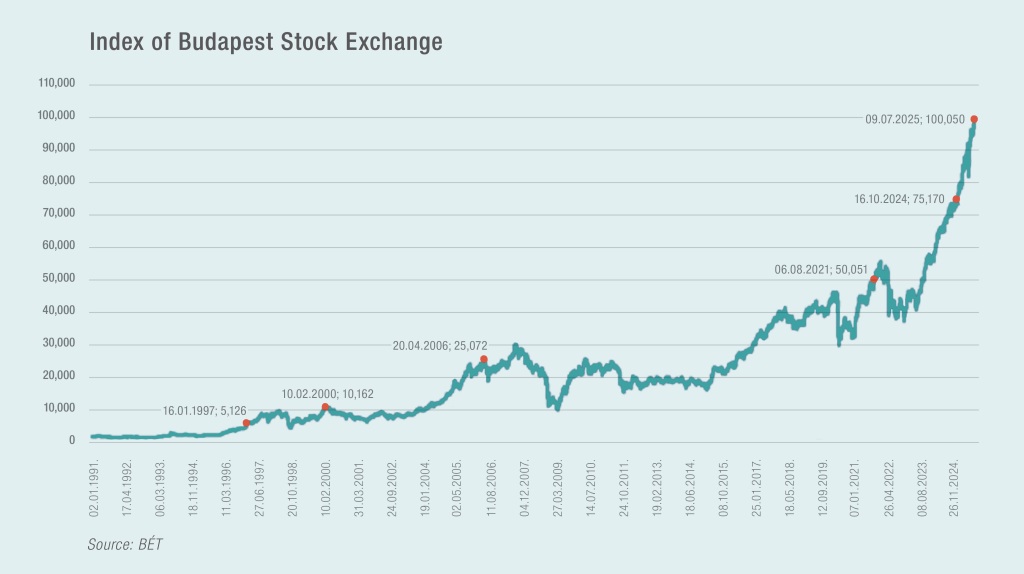

It has paid off to invest: the Budapest Stock Exchange’s (BÉT) main equity index, the BUX, has closed above the psychological milestone of 100,000 points for the first time, marking a new historic record for the local market. The index, which tracks the performance of Hungary’s largest and most liquid listed companies, started at 1,000 points in 1991. Since then, investors could have achieved a hundredfold return, equivalent to an average annual growth of 14%.

The most successful decade for the index was between 1995 and 2005, with an almost 1,500% increase. Over its roughly 34-year history, the BUX delivered positive returns in 24 years, with double-digit gains in 17 of them. According to data from the Hungarian National Bank, by the end of 2024, Hungarian households held over HUF 2,000 billion in domestic equities — more than five times the amount held a decade earlier.

This new peak reflects not only increased investor confidence but also the broader regional and global economic trends, as well as the strong performance of Hungarian listed companies (with stock indices from New York to Warsaw also reaching record highs).

Meanwhile, the Hungarian economy itself has been underperforming. This underlines that the majority of listed Hungarian companies earn a significant share of their revenues abroad. In the second quarter, Hungary’s GDP was only 0.4% higher than in the first quarter. The economy remains stagnant, with the first half of the year showing an overall 0.1% annual decline according to the Central Statistical Office. The industrial sector is weighed down by sluggish export markets, while agriculture has been hit by adverse weather conditions. Investments remain scarce, household consumption cautious, and for the full year, the Hungarian National Bank expects growth of just 0.8%, while the Ministry for National Economy projects 1%.

Equity market news

On July 28, the S&P 500 — the benchmark index tracking the share price movements of the largest companies listed on the New York Stock Exchange — reached a new record high of 6,390 points. Second-quarter earnings reports provided a boost to the equity market: nearly three-quarters of companies in the S&P 500 exceeded the already modest consensus expectations for earnings and revenue growth. This is a higher-than-usual proportion and supports the view that the political turbulence of recent months has so far had only a limited impact on corporate results.

Large-cap technology companies — the so-called “Magnificent Seven” — reported above-average earnings growth (17% vs. 4%), with revenue growth in the technology sector as a whole outpacing the rest of the market (14% vs. 7%). Among the flagships of artificial intelligence, Nvidia, Microsoft, and Meta Platforms (Facebook) have each seen their share prices rise by 25% in the first seven months of the year.

In addition, the financial sector also posted significant earnings growth, with average corporate profit growth across the S&P 500 coming in at around 6%.

The picture is less favorable in Europe, where the average second-quarter earnings result is expected to show a decline of around 4%. Continental technology leaders are suffering from the negative impact of U.S. trade policy on 2026 growth targets, while food and beverage producers are struggling with mounting challenges from weak Chinese demand.

Bond market news

Economic indicators in the United States have improved: the U.S. Consumer Price Index (CPI) data released in July came in slightly better than expected, with even core inflation rising less than forecast. Headline CPI increased by 2.7%, while core inflation rose by 2.9%. So far, the recent tariff increases appear to have had only a limited impact on prices. One reason for this could be that the actual tariffs paid by companies have been lower than the statutory rates: over the summer, due to inventory management adjustments and supply chain restructuring, the effective tariff rate was only 10% instead of 15%.

Although deteriorating labor market data and growing government pressure on the Federal Reserve to stimulate growth through cheaper credit could pave the way for interest rate cuts, our current outlook remains neutral.

In the euro area, government bond yields have started to rise on the back of improving growth prospects (the PMI rose more than expected to 51 points in July). However, the European Central Bank appears to have ended its rate-cutting cycle despite the low (2%) inflation rate.

Similarly, most emerging market central banks have also paused rate cuts amid renewed market uncertainties — even though easing tensions between the U.S. and China, as well as a de-escalation in the Israeli–Iranian conflict, have reduced the interest rate differential with developed markets, which had been higher earlier this year. At the same time, the strengthening U.S. dollar calls for caution, as a significant share of emerging market debt is denominated in dollars — making repayments in local currency more expensive when the U.S. currency appreciates.

Alternative investments news

Recessionary conditions continue to weigh on commodity markets — even gold has not been spared. Although the precious metal, traditionally viewed as a store of value and safe haven, is trading near its historical peak (around USD 3,400 per ounce), we believe its price has been following a certain pattern since April.

Gold is overbought — having now become the world’s second-largest reserve currency after the U.S. dollar, surpassing the euro. Its global market price failed to reach a new all-time high even at the outbreak of the Israel–Iran war, despite the fact that in the past, heightened geopolitical tensions typically drove significant price increases. Moreover, while the gold price in U.S. dollars has been stagnant, the American currency has depreciated by almost 10% since the start of the year. As a result, gold investments may even show a small loss when calculated in euros (or Hungarian forints).

The outlook for further gold price appreciation is also not encouraging. The technical picture is deteriorating: the price has broken below the 50-day moving average and is now testing the 100-day moving average. Should it fall through this level as well, the next key threshold for technical traders would be the 200-day moving average, corresponding to a price of around USD 3,000 per ounce.

What can we expect in the coming period?

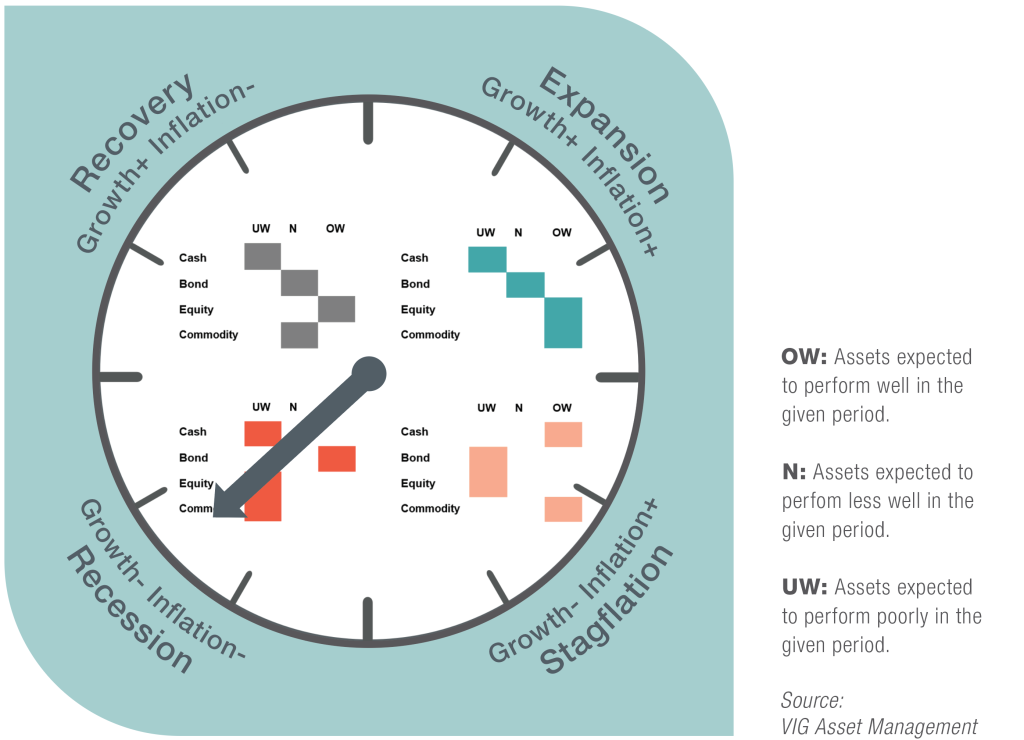

Investment clock

While there are some signs of improvement, the global investment clock remains in the recession phase. However, the picture varies across major economic centers.

In the United States, the labor market is gradually cooling, as certain sectors are no longer creating new jobs. The number of hours worked is declining, wage growth is slowing, and overall employment in July was lower than before. (In reaction to the disappointingly weak employment data, President Donald Trump even dismissed the head of the national statistics office.) That said, the situation is not catastrophic: jobless claims and non-farm payroll numbers remain stable, and inflation has eased slightly thanks to a moderation in housing costs. Second-quarter GDP growth exceeded expectations, and if there is no significant deterioration in the labor market or inflation, the U.S. economy could avoid a meaningful downturn.

Europe’s investment clock has been stuck in the recession phase for quite some time. Inflation in the euro area has stabilized at 2%, while the unemployment rate remains at a record low of 6.2%. Thanks to accelerated shipments ahead of potential U.S. tariffs, industrial production rose by 3.7% year-on-year, according to Eurostat. Much of this growth came from pharmaceuticals, with euro area pharmaceutical production surging 27.7% in May — a new all-time high. German fiscal stimulus measures are also supporting growth.

In China, the investment clock has been moving towards recovery, with the tariff war in the Far East prompting an increase in early economic activity. However, structural challenges remain. The world’s second-largest economy is battling deflation, and due to stagnant incomes and uncertain job prospects, consumer spending remains very low. The property market is weak, and the government’s 5% GDP growth target for the year may be at risk.

The clock indicator denotes the current economic cycle phase. Faded indicators reflect the previous situation.

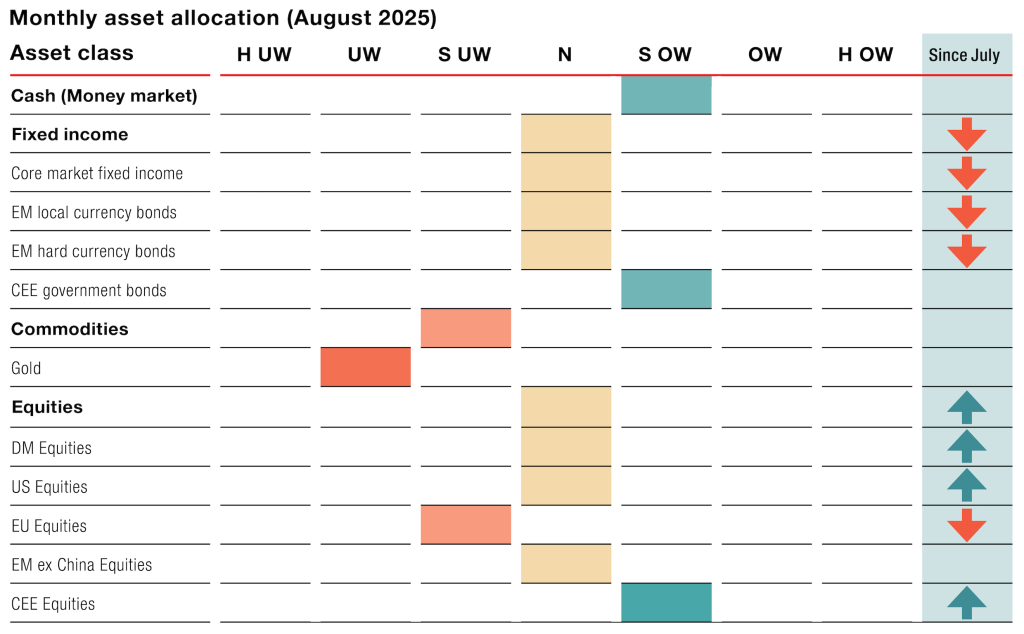

Tactical Asset Allocation

In line with the latest economic and capital market trends, we have made significant changes to our asset allocation. Compared to our previous positioning, our investment approach is now more neutral: we have downgraded bonds — despite the rule of thumb that they tend to perform well during recessions — and upgraded equities. Money market instruments remain overweighted, while commodities stay underweighted. This even includes gold, which has risen to record levels (above USD 3,400 per ounce) and has likely been purchased in excessive amounts by investors in recent years.

An Opportunity for Risk-Tolerant Investors – U.S. Equities

In the short term, equity market prospects may improve, primarily thanks to global technology companies. While earnings expectations in traditional sectors are weakening, large tech firms have once again “saved the day.” Long-term risks that influence equity markets — such as high valuations and a weak macroeconomic backdrop — still point downwards, but short-term positives are strong: major stock indices have reached new record highs (the S&P 500, which tracks the U.S. equity market representing 42.5% of global stock turnover, climbed close to 6,400 points in the last week of July). As a result, investor sentiment remains supportive despite recessionary concerns. The outlook for U.S. markets may improve further, while Europe’s appears slightly weaker than last month.

Central Europe May Continue to Lead

The Central and Eastern European region could deliver outstanding performance in both bonds and equities. Valuations for these assets appear particularly attractive, and in the event of an end to the Russia–Ukraine war — or even an unexpected ceasefire — further appreciation could follow. The region is a key target for capital flowing out of the U.S. due to the trend of a weakening dollar. High bond yields and strong corporate earnings growth potential act as powerful incentives. The depreciation of the U.S. currency also eases the repayment burden of dollar-denominated loans: according to the Hungarian Government Debt Management Agency (ÁKK), Hungary issued HUF 1,300 billion worth of dollar bonds in June, while Poland also holds a significant share of debt in U.S. dollars.

The weights indicate the evaluation of the respective country, region, and asset class, providing a basis for portfolio managers in structuring portfolios and establishing positions, thus helping to capitalize on market opportunities.

Weights:

- Strongly underweight

- Underweight

- Slightly underweight

- Neutral

- Slightly overweight

- Overweight

- Strongly overweight

Changes – change compare to the the previous month

The table was prepared based on our investment clock and quadrant modell**.

Focus fund: VIG Active Beta Flexible Allocation Investment Fund

The portfolio of the Fund is primarily composed of equities of U.S. and European companies and short-term government bonds from developed markets. The Fund invests in companies that are considered the most popular among business partners, employees, and investors alike.

The popularity of a given company is determined using a proprietary, specialized algorithm, combining quantitative and qualitative analysis. The equity allocation is adjusted flexibly, in line with prevailing capital market trends.

At present, the equity weighting is high (90%), reflecting the strong market sentiment — stock markets are booming. The portfolio includes high-profile, media-covered names such as:

- Palantir Technologies – the software company whose share price has doubled this year, making it the 20th most valuable U.S. company on Wall Street.

- Nvidia – the AI leader whose stock has risen more than fivefold in a year.

- DoorDash – the food delivery company posting annual profit growth of around 50%.

- Ryanair – the airline attracting headlines with its share buyback program.

Based on our expectations (based on tactical asset allocation), the fund of the month may outperform in the near future.

Disclaimer

This is a distribution announcement. In order to make well-founded investment decisions, please inform yourself thoroughly regarding the Fund’s investment policy, potential investment risks and distribution in the Fund’s key investment information, official prospectus and management regulations available at the Fund’s distribution outlets and on the Fund Manager’s website (www.vigam.hu). Past returns do not predict future performance. The future performance that can be achieved by investing may be subject to tax, and the tax and duty information relating to specific financial instruments and transactions can only be accurately assessed on the basis of the individual circumstances of each investor and may change in the future. It is the responsibility of the investor to inform himself about the tax liability and to make the decision within the limits of the law. The information contained in this leaflet is for informational purposes only and does not constitute an investment recommendation, an offer or investment advice. VIG Asset Management Hungary Closed Company Limited by Shares accepts no liability for any investment decision made on the basis of this information and its consequences.